The days of Walter Cronkite are long passed. You may recall the days of Cronkite’s CBS Evening News broadcast when he concluded every broadcast with, “And that’s the way it is.” Cronkite became known as “the most trusted man in America” due to his diction of facts and clear delineation when opinion was rendered. Current day media could take a lesson from Cronkite to regain much of that lost trust.

The days of Walter Cronkite are long passed. You may recall the days of Cronkite’s CBS Evening News broadcast when he concluded every broadcast with, “And that’s the way it is.” Cronkite became known as “the most trusted man in America” due to his diction of facts and clear delineation when opinion was rendered. Current day media could take a lesson from Cronkite to regain much of that lost trust.

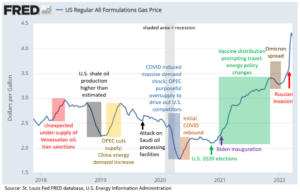

Recent gas price presentations are meant as a proxy of the recent American families’ financial plight. Gas prices are a reasonable surrogate as they are immediately and directly seen by even the most innocuous observer. Gas prices also impact every product and service we consume. Where the media goes wrong is their selective discussion points while implying they are the sole keeper of objective fact.

Watch one news source and high gas prices are blamed on Russia invading Ukraine. Read a different source and high gas prices are blamed on the XL pipeline cancelation. Like medicine, the truth can be hard to swallow. Well, hold your nose and tilt your head back, the truth is… all the above and more.

Pricing of any commodity is far more complex than whittling it down to a single inflection point. This is especially true for globally based commodities which have many different supply sources and demand needs. Inherently, we all know this is the case. Yet, brevity, the desire to appear knowledgeable as well as an increasing subjective narrative obfuscates media objectivity and leads to an incorrect binary position.

Did the Russian invasion drive prices higher? Yes. Did XL pipeline and land lease cancelations increase gas prices? Yes. Does the lack of U.S. or Canadian oil procurement effect gas prices? Yes. Did the increased demand from a COVID-emergent citizenry increase prices? Yes. Does OPEC supply effect prices? Yes. Did lack of oil availability from decrepit Venezuelan oil wells increase prices? Yes. Are gas prices being influenced by energy companies needing to prepare for possible restricted future oil supply? Yes.

Economic courses teach prices are a function of [current] supply and demand. Theory is different from reality. Price reality is also influenced by future potential supply and demand. The impact of a major energy producer being sanctioned for world events, or the impact of a major producer’s energy transition policy, or projected travel all impact the current price of gas… not just current availability versus current demand. Revisiting Cronkite’s search for the truth and honesty would help regain media trust and lift the discourse we see today.

The emerging Cherry Blossom bloom indicates father winter is preparing for his slumber.

CRN-4652270-033122

Recent Comments