This year may be termed the “Year of the Mundane.” Talk of interest rates, bond markets and federal debt are typically met with a vivacious chorus of yawns. I guess talk of the nation’s first default gets people’s attention, though it is highly unlikely to occur.

It may be worthwhile exploring how the media takes advantage of our primal urges to control viewers’ perceptions. The media takes control of the brain’s emotional center (the limbic system and amygdala) directing blood flow away from the rational reasoning frontal cortex. But that’s for a future newsletter.

Most recently, the media has sent everyone into a tailspin over the extremely unlikely U.S. Federal government default. Since 1960, Congress has acted 78 times to permanently raise, temporarily extend, or revise the definition of the debt limit1. To those doing the math, that comes to debt ceiling debate about every 10 months, on average. Who knew debt ceiling debates were far more routine than the recent round of rabble rousing would suggest?

The latest brinkmanship seems to be more of theater than bona fide consequences. Those around long enough may recall past tense debt ceiling debates of January 2023 or 2021…actually, not long ago. Please pardon the skepticism of the threatened U.S. default, but if history is a guide, the chances are extremely unlikely. At the end of the day and often in the 11th hour, congress will come to some compromise which often includes spending concessions and a debt ceiling increase. At the very least, all congressional members and the president recognize the importance of the full faith and credit of the U.S. Government. As discussed in a past newsletter, the U.S. dollar is the world’s reserve currency, the foundation for global transactions and considered the “risk-free rate” of which virtually all financial securities are priced off.

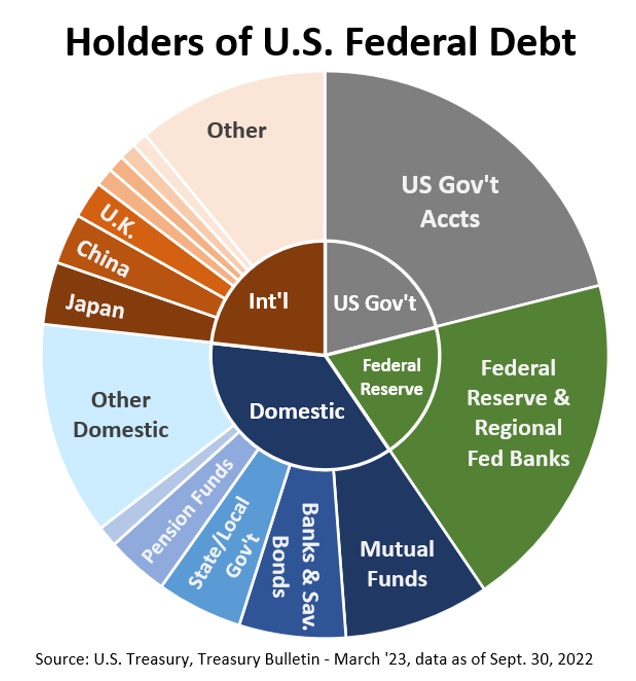

The Federal debt is often comingled with a discussion of U.S. debt holders. Interestingly, articles presenting “holders” tend to focus on the international component and disregard the whole picture. International holders make up about 23%2 of outstanding U.S. debt. The top three country holders (Japan (3.6%), China (2.9%) and U.K. (2.1%)2) have a similar weighting as the Treasury securities held in the mutual funds. It is often suggested the U.S. is beholden to China due to China’s Treasury security stockpile. The bigger picture reveals China’s true weighting, yet talking heads prefer emotionally charged audiences be disconnected from the logical and reasoning brain centers.

Could the U.S. default on its financial obligations? Anything is possible. There are no guarantees in life. The better question is, “is a default probable?” The answer to that is… it is highly unlikely due to historical precedent, recognition of U.S. dollar’s reserve status and impact on financial markets… domestic and global.

1U.S. Treasury, https://home.treasury.gov/policy-issues/financial-markets-financial-institutions-and-fiscal-service/debt-limit

2U.S. Treasury, Treasury Bulletin- March 2023, data as of Sept. 30, 2022.

The opinions expressed are those of Heritage Financial Consultants and not necessarily those of Lincoln Financial Advisors Corp.

CRN-5694673-051823

Recent Comments