Surprise! What was expected to be a turbulent quarter turned out to be absent volatility. Yet, the list of worries compounds with tariffs, inflation fears, policy uncertainty, social unrest, a soft housing market, and cracks in the labor market. Some are bona fide concerns, while others are perpetrated by the media needing to fill airtime. There is an old market adage, “Every bull market climbs its own wall of worries.”

The 90-day tariff pause soothed investors’ nerves. The US utilized the time to negotiate bilateral agreements with many nations and regions. Others received letters spelling out new rules of engagement. A Federal appeals court declared the tariffs illegal, though they were allowed to remain in place pending review by the Supreme Court. Despite legal challenges, tariffs were increased on target products to reshore US industry and manufacturing, some for economic purposes and others for security reasons.

Many of the tariff/trade negotiations, coupled with the One Big Beautiful Bill Act (OBBBA), provide front-loaded stimulus to consumers and businesses alike. Foreign Direct Investment (FDI), or infrastructure investments by foreign countries, was built into many of the important trade deals (i.e., Japan and the EU). The OBBBA extended expiring tax cuts (from Trump’s first administration), offered many new tax deductions (such as tips and overtime), and accelerated expensing of manufacturing buildings. This gave the working-class immediate cash flow and prepared infrastructure stimulus into 2026.

Mixed economic measures did suggest softening, in the aggregate. Most notable was the drop in hiring and the massive 911,000 downward revision in jobs between April 2024 and March 2025. Yet, there was little deviation from the standard layoff cadence, suggesting companies took a wait-and-see attitude toward expansionary efforts. The housing market saw its worst selling season in years as mortgage rates remained elevated. In the end, the US economic resilience and the power of consumers’ willingness to spend money overwhelmed any weakness.

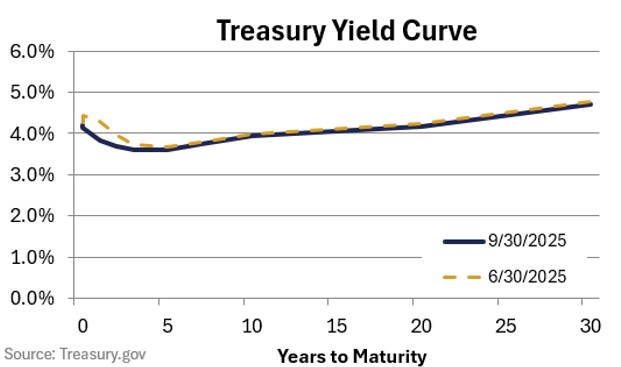

On a clear positive note, the quarter concluded with the Federal Reserve (Fed) cutting rates. Noting weakness in the labor market, the Fed decided to re-focus on its second mandate, supporting full employment, and putting the inflation battle on the back burner. The Fed rarely makes a single rate cut, so more cuts are likely on the way. Lower rates are stimulative to the economy as businesses and consumers should see lower financing rates.

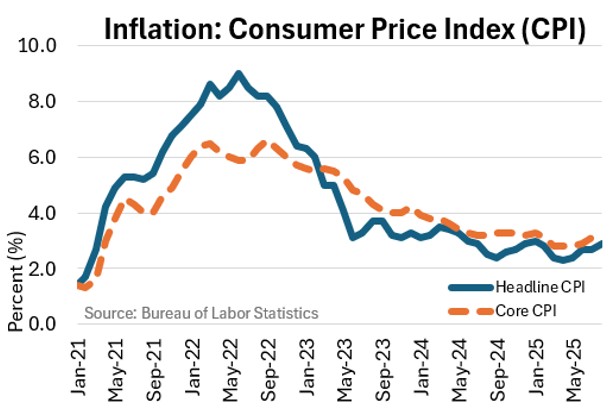

Inflation has stabilized in the upper 2% – 3% area. This is higher than the Fed’s target, but in line with long-term averages. We realize the current inflation seems high, but the low inflation between 2010 – 2020 conditioned us to assume 2% is normal when it was historically abnormal. The inflation game is not over, as inflationary pressures are being countered by deflationary pressures.

EQUITY MARKETS

Global equity markets marched forward with abandon, continuing their recovery from the April lows. Stock markets widened dramatically beyond the famous Magnificent 7 of the past. Smaller companies took the lead, leaving their big brother brethren in the dust. Both US and international markets clocked new highs, with all industry sectors in the black with positive returns. The pace of international stock appreciation waned a bit, but international stocks were able to maintain their overall year-to-date lead.

We started this section specifically referencing “with abandon” on purpose. Even with growing concerns, stocks pushed higher despite risks and very high valuations, especially for US large caps. Stocks, especially US large caps, are pricing in perfection, hence any minimal disappointment could lead to near-term volatility. But as mentioned above in the economic discussion, the groundwork is being laid for future advancement. Cautious and selective deployment of capital may be warranted at this juncture.

FIXED INCOME MARKETS

The last few years have been challenging for fixed-income investors. The 2022 bond market, driven by unprecedented rate spikes, has given way to a solid foundation for bonds in 2025 and going forward.

Yields changed little throughout the quarter, leaving bond investors content with clipping the coupon. Bonds are back in favor with formidable starting yields and the Fed’s tailwind via rate cuts.

Similar to the equity markets, riskier bonds are showing signs of euphoria. Low credit qualities, i.e., high-yield bonds, are experiencing very narrow credit spreads rarely witnessed in the past. Credit spreads are the extra yield required to entice bond investors to move away from the riskless US Treasuries. Narrow credit spreads indicate bond investors, at least low credit quality bond investors, are pricing in perfection. Unfortunately, things are rarely perfect. Caution is suggested, underweighting lower credit qualities.

CONCLUSION

Investors ended the third quarter on a high. The near-term risks were ignored in favor of the intermediate possibilities. We escaped the September doldrums (September tends to be the worst month for equity investors), but we haven’t escaped the potentially explosive October. Many significant historical declines occurred in October. Should we experience a drawdown, it is best not to waive from your financial path as volatility considerations have been built into your portfolio.

Recent Comments