Perseverance best describes the U.S. economy, the global economy, and the financial markets. All three have powered through tariff-induced trade shocks, immigration changes, and the longest U.S. government shutdown in history. Whatever exogenous shocks are thrown at it, the economy and the financial markets shrugged them off and moved forward.

The primary basis for such resilience is the American public. Americans continue to spend despite their dour outlook, job market concerns, and price level worries. Who can blame them? With tremendous cash hoards, rising stock market wealth effects, and a tolerable Unemployment Rate, have encouraged consumers, in aggregate, to spend.

Businesses poured gas on the fire with enormous capital investment in Artificial Intelligence (AI)/robotics and data center construction. The AI/robotics buildout has been equated to past secular changes of the 1980s PC revolution and the 1990s internet innovation. As with any secular change, there will be a number of early entrants that won’t make the cut, but it would be hard to argue against the increased productivity, move away from mundane or dangerous travails, and ultimate economic benefits.

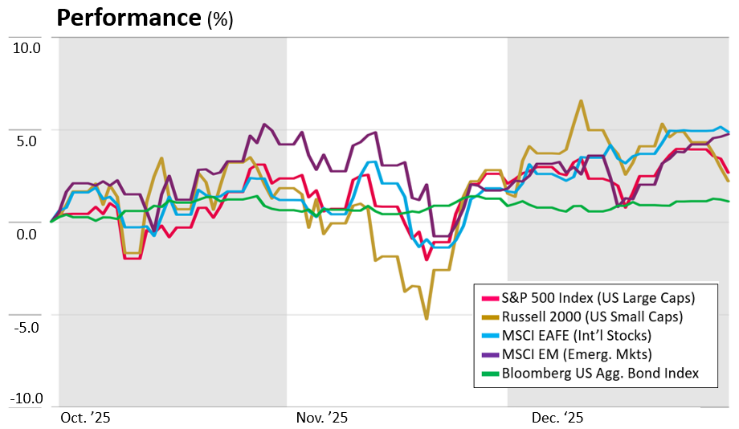

Volatility was injected into the market during the first half of the quarter due to government shutdown speculation and shifting labor market concerns. In either case, volatility subsided as initial fears proved unfounded, giving way to a healthy Santa Claus rally.

The Federal Reserve (Fed) recommenced its rate cut cycle after a nine-month pause. The first cut came as the third quarter closed, followed by two cuts in the fourth quarter. The justification was due to softening labor markets. Financial markets mostly took the news positively as investors equate lower interest rates to a growing economy, rising corporate earnings, and positive bond market returns.

The most surprising event of 2025 was the miscalculation by so many well-known economists from highly respected firms. The overwhelming majority called for a significantly weakened economy, if not outright recession, with a return to high inflation due to the tariff opaqueness. The reality is the economy saw some positive accelerating growth with inflation hovering around 2.5%-3.0% for most of 2025. The economic acceleration was not isolated to the U.S. The global economy, manufacturing and services sectors alike, pivoted from April’s Liberation Day doldrums uncertainty to positive gains as the latter half of the year progressed.

The AI/Robotics theme resumed leadership in the fourth quarter. Software and hardware companies are not the only benefactors of this trend; energy and infrastructure sectors participated as well. AI servers require semiconductor chips, data centers, and copious energy consumption. The energy needs cannot be supported by a single energy type. Consistent, reliable energy will require energy from renewables, to fossil fuels, to nuclear.

The fourth quarter began to recognize benefits from the One Big Beautiful Bill Act (OBBBA). The OBBBA added new deductions for workers (such as deductions for tips, overtime work, car loan interest, and bonus deductions for seniors), permanently extended tax rates from the Tax Cuts and Jobs Act (TCJA), expanded standard and SALT deductions, and significant depreciation write-offs to springboard businesses into 2026 and beyond. Not to mention special deductions to help reshore technology facilities and manufacturing.

EQUITY MARKETS

Equity Markets shrugged off the quarter’s first half volatility and embraced the Santa Claus rally, netting solid gains for the fourth quarter, though low post-Christmas trading volume gave back some of December’s gains. Solid positive gains were realized across the board in all major asset classes, domestically and internationally. Non-US stocks benefited from a falling dollar, making non-US stocks the biggest winners for 2025.

Healthcare stocks led stocks in the fourth quarter. There are a few broad reasons healthcare stocks outperformed in the fourth quarter. One of them is simply a rotation out of high-valued tech stocks into a more defensive sector like healthcare. Healthcare stocks are generally seen as somewhat of a safe haven when volatility rises, as healthcare is needed no matter the economic conditions. Secondarily, the Fed’s rate cuts made it cheaper to develop new drugs and treatments.

U.S. large cap stock valuations remain our top concern, making stocks sensitive to negative news or news that does not live up to the hyped expectations. Hence, investors should be prepared for a bull market correction.

FIXED INCOME MARKETS

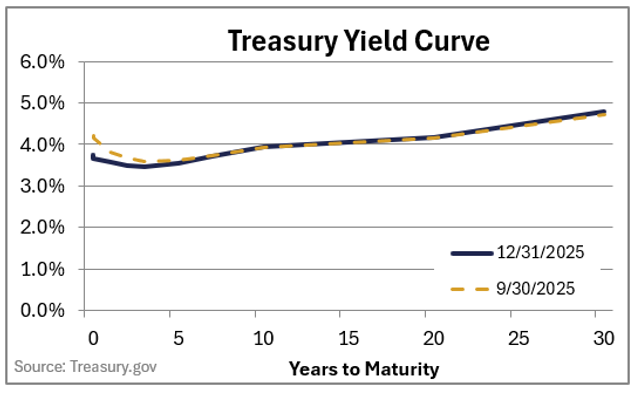

Fixed-income markets followed equity markets with solid gains. For fixed income markets, this means gains between 1%-2% for the quarter. With the Fed cuts rates impacting the short end, the yield curve (a graphical representation of yields lined up by maturity) has returned to a normalized upward sloping line, indicating economic growth ahead.

Credit spreads (the additional yield required to entice bond investors to invest in corporate bonds over Treasuries) are near all-time lows. Narrow credit spreads suggest highly valued low-credit bonds. Said another way, the bond market is minimizing bond market threats. Historically, narrow bond spreads are ultimately met with an unforeseen hazard, causing low-credit bond investors to seek higher ground. Narrow spreads should prompt bond investors to remain vigilant.

CONCLUSION

Despite the government shutdown and the quarter’s initial volatility, the fourth quarter ended on a high note. Economic growth and financial market performance in 2025 have been resilient despite a substantial drag from trade, consumer worries, and weakening labor markets. Consumer spending and business investment kept the economy accelerating forward. Even better, the economic headwinds are abating while fiscal and monetary stimulus is becoming stimulative. Betting on individual sectors or asset classes may be a fool’s errand at this point. Maintaining a well-diversified portfolio remains the best way to achieve financial goals.

www.heritageconsultants.com

The opinions expressed are those of Heritage Financial Consultants, LLC and not necessarily those of Osaic Wealth, Inc. Forward looking statements may be subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. Russell 2000 measures the performance of US small cap stocks. MSCI EAFE measures the performance of large and mid-caps of developed markets excluding the US and Canada. MSCI EM measures the performance of the large and mid-caps of emerging market equity securities. Bloomberg US Aggregate Bond index measures the performance of US investment grade bonds, including Treasuries, government agencies, corporates, MBS and ABS. Securities and investment advisory services offered through Osaic Wealth, Inc., member FINRA/SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth.

Recent Comments