As the World Turns. A popular daytime soap opera spanning the ‘50s, ‘60s, ‘70s, and ‘80s seems to capture our current global predicament. The earth continues to spin, unaware and indifferent to the latest Mideast turmoil.

This past weekend, we learned of the latest round of strikes against Iranian nuclear targets. The US attempted to squash Iran’s nuclear weapons development in hopes of an ultimately safer world. Military confrontations understandably cause anxiety and unease for those involved, as well as unaffiliated parties.

The latest round of strikes directly introduces a new participant, the US, into the instability of the Mideast. Meanwhile, the Russia-Ukraine war has been going on for nearly 2 ½ years. Geopolitical strife has grown from a nuisance to a serious risk.

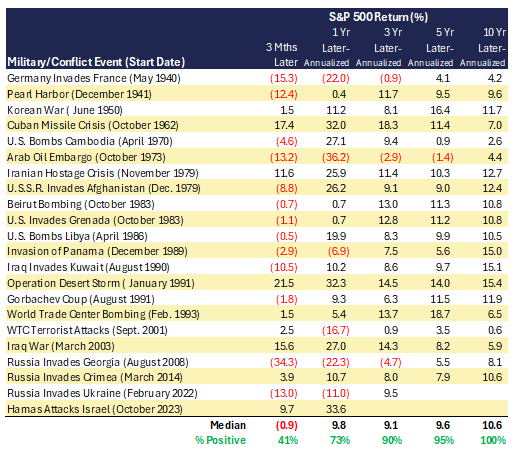

Taking cues from historic entanglements can offer a framework and insight into how markets react during major and minor conflicts. Reviewing conflicts over the past 85 years, including WWII, various regional wars, one-off attacks, coups, and other skirmishes, you may be surprised to find that the stock market mostly eschews military action.

An initial reaction, as observed by the initial 3-month returns, results in a decline only 59% of the time. This is far from what one may expect. Fast forward 1, 3, 5, and 10 years to find stock market returns echo broader stock market performance; including boom periods, busts, robust economic times, recessions, industry obsolescence, competition, outsourcing, etc. In other words, geopolitical conflicts occur frequently enough that the stock market does not consider them a catastrophic threat.

During periods such as these, we caution investors to resist reflexive and hasty reactions, abandoning their financial objectives. Initial declines, if any, tend to give way to positive rebounds as investors’ worst fears are replaced with more reasoned judgments.

We realize there is One Life to Live in the Days of Our Lives. We hope The Secret Storm subsides as all parties follow a Guiding Light to more a peaceful and prosperous Search for Tomorrow leading to Another World. We will continue to monitor the evolving Mideast situation and evaluate implications for financial markets.

Recent Comments