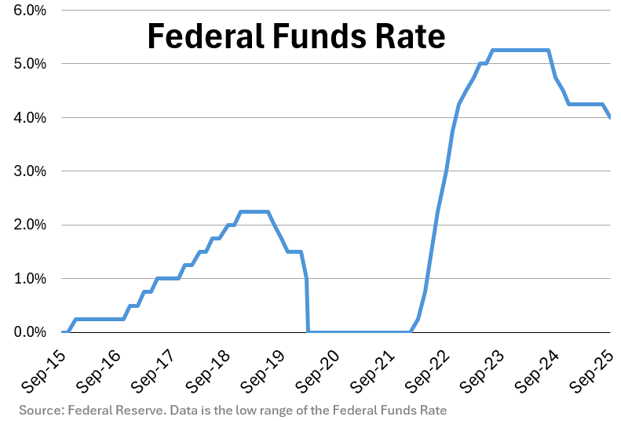

Dual to Dueling. The Federal Reserve (Fed) has two mandates: control inflation and support full employment. Stubborn inflation (over the Fed’s 2% target) and softening labor markets have different policy prescriptions. During last week’s Fed meeting, the Fed sided with labor market concerns by cutting interest rates by 0.25%.

The Fed reduced its key policy rate primarily due to weak job reports. The hiring malaise is due, in part, to the uncertainty originating from the tariffs and trade disputes. Going forward,

the labor market is going to get preferential treatment. The Fed’s policy decisions tend to have a delayed impact on the economy, so last week’s rate cuts may not be felt until December or January. This is likely the start of a new rate cut cycle with another 0.50% – 0.75% to be slashed. We estimate the rate cut cycle will conclude just in time for the Spring house-selling season.

In a previous newsletter, we highlighted the low-hire/low-layoff environment. Hence, hiring may have stalled, but not enough for the unemployment rate to rise to levels commonly associated with a recession. This gives us confidence that the soft labor market data is a mid-cycle slowdown as opposed to signs of economic deterioration.

The overall economy has remained resilient so far this year despite worries that higher tariffs might trigger a recession. No such downturn has materialized yet. U.S. GDP growth rose 3.3% in the second quarter. However, economic data is split with some positives and some negatives. Given the strength of consumer spending, which accounts for about 2/3rds of the economy, and the relative strength of the consumer financial position, it’s hard to envision dire economic circumstances.

To boot, accelerating business investment and respectable domestic industrial production indicate businesses are ramping up to contribute to economic growth in the coming months. An additional benefit of a supply-side expansion is minimal inflationary pressure. Lower interest rates should contribute to business investment and business expansion projects.

We recognize that this week’s letter may seem gung-ho during a period of media-highlighted softening data. Admittedly, we are looking a little bit ahead and not directly down at our feet. In reality, we are cautiously optimistic, aware that our thesis could be adjusted by errant data. Unlike the past few years of unequivocal positive economic data, the current environment is more akin to normalized mixed data. Yet, recency bias has conditioned people to see anything but perfectly positive as recessionary, which is far from the case. It is important to keep our emotional centers in check while staying alert for changes.

Recent Comments