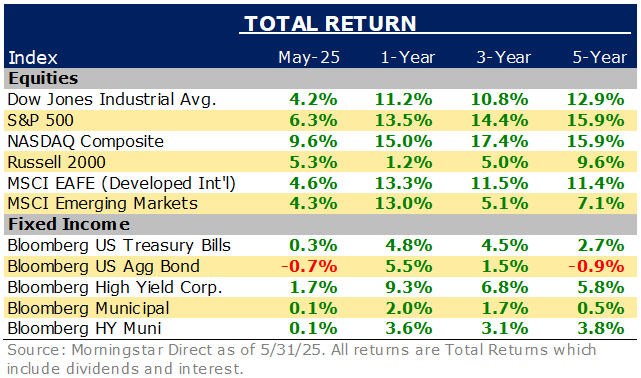

May was a welcome reprieve! The previous three months had investors a little jittery, especially with Trump’s “Liberation Day” announcement launching a round of volatility. May marched back to breakeven territory for most financial markets.

The final week in May put the icing on the cake. Most equity markets received a final push close to or above the year’s beginning value. The sole hold out being U.S. small

cap stocks with a year-to-date return remaining in the negative mid-single digit return category. International stocks and emerging markets have fared best with year-to-date double-digit returns and high single-digit returns, respectively. Taxable bonds are in the low single digit positive territory, while tax-free municipal bonds are just shy of breakeven.

May’s volatility seemed to correlate with tariff headlines. The net effect of the positive and the negative declarations was a move towards constructive global trade bargaining, enough for the trading gods to sprinkle appreciation upon investors. The on-going trade negotiations suggest we are not out of the trade war storm, just that the clouds have thinned and darker clouds seem to be dissipating.

Negotiations between the world’s number one and number two economies (U.S. and China) still have a way to go. The U.S. has a number of cards in its hand, including breadth and depth of the U.S. economy, command over the world’s reserve currency, allied developed economies, and manufacturing exodus from China. China’s cards include global dependence on low-cost Chinese manufacturing (at least in the near term), a large retail base (though indications are Chinese consumers are financially strapped), and the heir apparent to the anti-western economic paradigm. Unfortunately for China, China’s South Pacific provocations are earning China military and economic foes.

May 2025 saw mixed signals in credit markets. While consumer credit trends remained stable, pockets of the U.S. corporate debt market showed signs of stress, particularly among riskier borrowers. High-yield credit spreads widened due to economic uncertainty but later tightened as market optimism returned. Without much of a prelude, Moody’s downgraded U.S. credit rating, citing concerns about government debt. Bond markets shrugged off the announcement with a quick realization that U.S. credit is still the world’s best sovereign option and remains the world’s the world’s reserve currency without a contender in sight.

Labor markets and consumer spending continue to defy predictions. Both remain strong in light of tariff threats and calls for economic recession. Of particular note is the declaration of the first quarter’s Gross Domestic Product (GDP), the economy’s scorecard. The first quarter clocked a slightly negative reading. Yet, further analysis revealed the venture into negative territory was a result of massive import volume as businesses prepared for possible tariff impacts. Imports are a deduction from the GDP.

The lesson for May was not to let near-term bluster guide your investment decisions. Daily news and commentary can resemble flag flapping on a gusty day.

Recent Comments