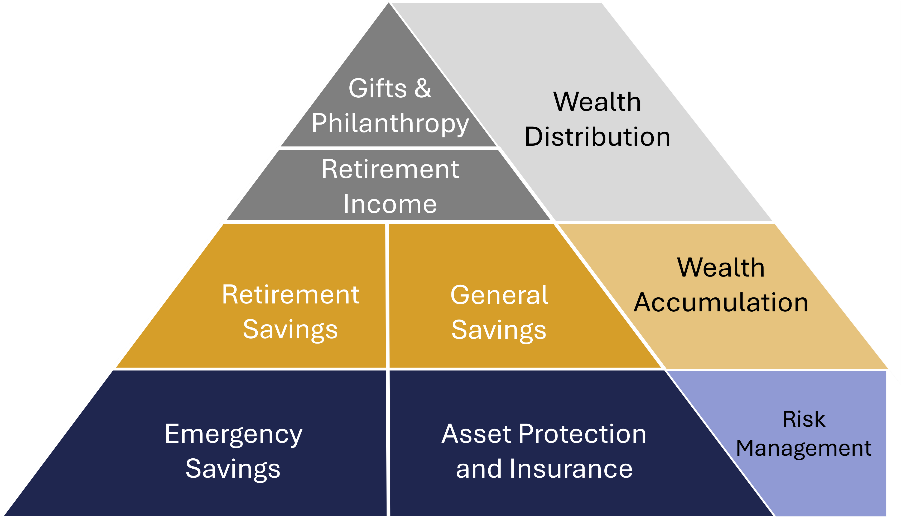

These newsletters are mainly geared to provide perspective on investments, markets, and economics, i.e., the areas that closely impact investment management. Investment management falls under the broader wealth management industry. Oddly, many firms in our industry only offer investment management services yet label their narrow offerings as wealth management.

Wealth-based portfolios incorporate various areas, such as tax management (annual income taxes, investment fund taxation, as well as estate taxation), estate planning, business succession (for business owners), stock options/grants (for corporate managers), and risk management. We would like to refer to our portfolio designs as “Wealthfolios” as we consider all areas of wealth management to develop a portfolio to meet your needs.

With that in mind, we wanted to focus this week’s newsletter on an often-ignored area… risk management. (Yes, investment management is inherently risky. Even stashing cash under your mattress exposes one to purchasing power risk, a.k.a. inflation risk, where future dollars buy less than current dollars. But we’re not talking about portfolio-oriented risks.) In this week’s context, risk management refers to non-portfolio risks, risks beyond your portfolio that could negatively impact your life savings. These would be things like creditors, accidents, unforeseen disabilities, or sudden passing. All these risks can impact your investment portfolio, wiping out the fruits of your labor or negatively impacting your loved ones.

Although it may be boring, it is important to begin every portfolio with a discussion of risk management. What would you do if something beyond your control or unforeseen affects you? How would you pay for it? Is there an insurance policy that can cover a given risk? If so, should you offload said risk in whole or in part?

As car owners, we’re required by state law to carry insurance to protect our fellow citizens (and your assets) if an unfortunate accident happens. For homeowners, mortgage covenants require you to carry home insurance. These insurance policies protect you from the negative financial shocks should you be stricken with a potentially catastrophic situation.

When it comes to life insurance, disability, long-term care, general umbrella insurance, and even health insurance for some, we often postpone making such decisions. We often rationalize that the chances are not likely, or the lack of immediacy makes it easy to delay enacting an insurance policy. The problem is that without adequate insurance, a portfolio may need to be reconfigured to account for adverse possibilities.

We often delay insurance purchases or begrudgingly pay insurance premiums. It’s easy to separate insurance from investments. The reality is that insurance is an asset protection device. Within a wealth management context, insurance is foundational. It’s important to make sure you have the proper insurance and appropriate amounts in place. When was the last time you reviewed your insurance policies?

Recent Comments