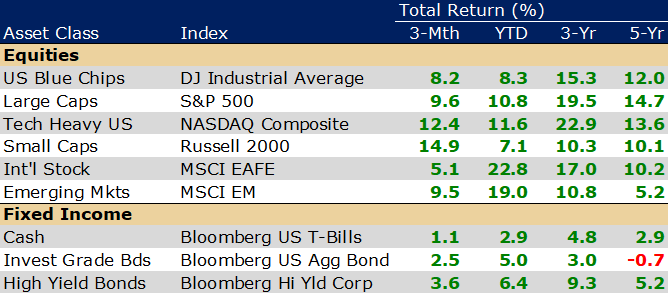

Welcome to the BER months, months ending with “ber.” Ber months signal a return to regular schedules and give us time to reflect on the summer. Despite persistent geopolitical tensions and headline-dominating-back-and-forth tariff negotiations, the global economy showed signs of cautious optimism, giving fodder for the financial markets to advance.

In the short term, equity markets are a relative market. Meaning, equity markets advance or decline on news relative to preconceived market assumptions. Spring months were dominated by very pessimistic tariff scenarios, setting up a floor if said scenarios didn’t transpire. Reflation, international trade wars, and a global recession did not happen. What transpired was stable inflation, mostly uninterrupted international trade, and growing revenue/earnings. Stocks surged off the pessimistic floor as cautious optimism replaced pessimism.

Risk was back on the table. The Magnificent 7 stocks retook the lead as investors rekindled their favoritism toward technology. Energy, materials, and industrials came in second, third, and fourth, indicating renewed interest in manufacturing. This is likely a byproduct of countries’ Foreign Direct Investment (FDI) commitments.

Labor markets were the main source of pain. July’s employment report was met with much disappointment, while June and May’s numbers were revised down. Non-human labor is being leveraged by business. Kiosks, ordering apps, and AI/robotics are replacing mundane or dangerous tasks. Job-related technological deployment is not new, but technology is being implemented faster than ever before. Displaced workers and new entrants may need to think differently about value-added employment.

Fixed-income markets continued earlier advances. The Federal Reserve (Fed) held rates constant through August 2025. This differs from central banks around the world, which have been cutting interest rates for quite some time. Yet, finally, in the last couple of weeks, Fed Chairman Powell suggested rate cuts were on the horizon, with a propensity for a cut as soon as the September 17th Fed meeting.

Inflation has been a bit of a sticking point, figuratively and literally. As investors weigh every inflation report for any directional insight, inflation has remained higher than the Fed’s 2% target. Much of this is due to sticky housing inflation, which has been coming down very slowly.

Gauging economic trends has been challenging in 2025. Near-term trend reversals have been the norm for much of the year. On the flip side, stocks ultimately look to earnings for their changes, and earnings have been very positive, conditioning investors with below normal volatility. We feel stocks have entered frothy valuations, which could lead to elevated volatility relative to the summer months.

Recent Comments