A break in the Winter doldrums seems to be afoot. Yes, we’re talking about the weather and the economy’s soft spot… labor markets. Labor markets have experienced similar hot/cold traits, causing many to ask what is really happening. We mentioned in previous newsletters that we would be closely monitoring employment data.

Most of the recent labor and jobs data gave mixed indications. Some headline numbers indicated the

labor markets have softened further, yet a deeper dive indicated it wasn’t that bad. However, Wednesday’s release of the January Employment Report gave reasons for the market to cheer.

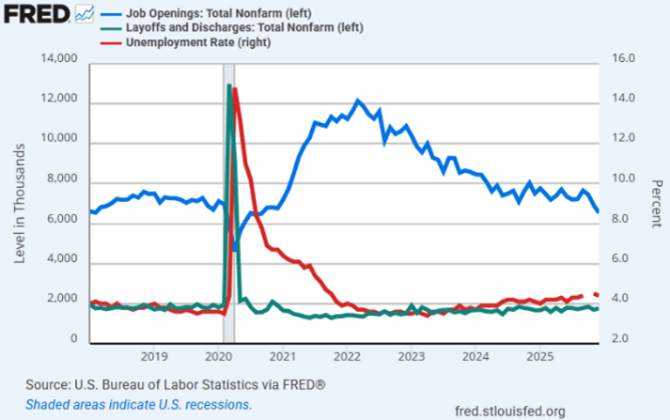

The first report was the Federal Reserve’s (Fed) favorite, Jobs Openings and Labor Turnover (JOLTS) report. The headline number showed a large drop in the number of job openings. This is the first dip below 7 million available jobs since 2020. Upon further examination, the data was from December… delayed due to the Q4 shutdown. Secondarily, the biggest pullbacks came in the retail sector and office workers. Both areas tend to pullback in December as holiday workers are no longer needed, and businesses tend to announce layoffs as they start to focus on the upcoming year.

To garner a better view of the labor market softness, we want to see if companies are firing personnel. Luckily, the JOLTS report addresses this. The JOLTS report measures actual separations in the given month. Upon review, we find the layoff number is in line with the monthly churn. As noted above, this is the delayed December number, so take it with a grain of salt.

The next report was the Challenger Report, which tracks layoff announcements. The Challenger Report is created by Challenger, Grey and Christmas, an outplacement company. The January number was much higher than anticipated. Upon a closer look, two companies (UPS and Amazon) accounted for 43% of the announced layoffs. Once adjusted, the remaining layoffs were in line with normal oscillations. Interestingly, UPS announced that layoffs resulted from the loss of Amazon shipping contracts. The separations will be implemented via attrition and voluntary buyouts rather than involuntary layoffs, so not really firings or layoffs.

Let’s look at people filing for Unemployment Insurance. Initial claims get all the attention, which have been trending higher. Yet, Initial Claims are simply filed requests for unemployment, which can be rejected or not needed after the first week. A better lens for Unemployment Insurance is Continuing Claims, paid unemployment claims for at least 2 weeks. Continuing Claims have been falling over the past four weeks. Another case of the deeper dive painting a different picture than the headlines.

Here comes the real home run. January’s Employment Report (the most important due to its depth and breadth and timeliness) blew away all expectations. It showed big employment gains almost across the board, with surprises in manufacturing and construction jobs. These are important as these are forward-looking jobs, not to mention a lower Unemployment Rate.

One thing can be said for the latest round of labor reports… the consistent murkiness. We’ll stay on top of the news and data, looking for a break in the clouds. Stay warm.

Recent Comments