Elevated, but controlled. That is the best way to describe our current inflationary situation. The media’s “inflation” curiosity has reignited. Reviews of articles, interviews, and podcasts seem to lack a historical backdrop or reasonable context of current pressures, resulting in elevated readership anxiety. So, let’s relook at the inflationary picture.

Historical perspective: Many commentators have suggested, explicitly or implicitly, that the

current inflation is high. In fairness, we need to examine the historical record to evaluate such statements. The US inflation tally goes back centuries. Yet, the official inflation measure, the Consumer Price Index (CPI), was started in 1913.1 Certainly, the economy, the economic makeup, and economic relationships have vastly changed over the past 112 years. So, we’ll focus on post-WWII as this was a global turning point.

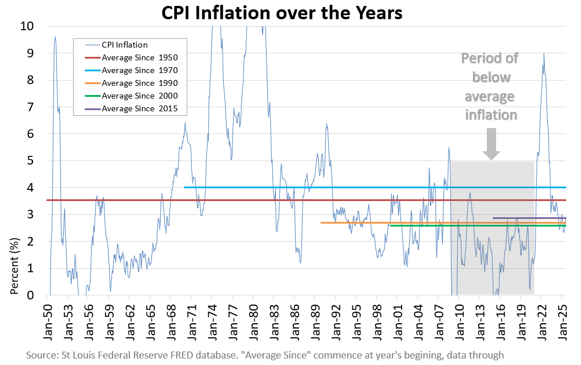

The accompanying chart displays CPI since 1950 with averages over the past 10, 25, 35, 55, and 75 years. There is no magic or manipulation of these periods. These are representative of various long-term averages. Seemingly, the current sensationalized high inflation claims do not seem to be supported by the historical record. Current inflation closely approximates averages over the past 10, 25, and 35 years. Of note, the 2010 – 2020 low inflation period may have conditioned us to erroneously assume sub-2% inflation was normal.

Current Environment: The current environment has dueling influences. Top of the inflationary side are tariff impacts. Though tariffs present possible inflationary pressure, historically, tariffs have about a 50/50 chance of resulting in inflation… coin tossing probabilities. For proper perspective, current-day tariffs, assuming enactment, are to be imposed on imports. Imports make up less than 14% of the US economy.2 Further, tariffs are not being fully assessed against the consumer. Some are absorbed throughout the supply chain, seen as reduced corporate profit margins. (FYI, about 73% of our economy is services,2 which by its nature can’t be imported nor tariffed.)

There is a concern about the latest tariff volley. Trump recently announced an additional 100% tariff on Chinese goods. With all the “made in China” labels, it may be surprising that China accounts for a little more than 13% of all imports.2 (This is down from nearly 22% in 2018.2) It takes millions of plastic toys to equal the import of a Toyota or a BMW. No wonder we perceive that everything is made in China, as we are exposed to millions of smaller items. In sum, 13% (China’s import share) of 14% (total imports) is only 1.8% of the US economy. The reality is that Chinese price changes (tariff or otherwise) are not as impactful as the presumptions.

There are other inflationary pressures, such as re-shoring supply chains and manufacturing. Yet, there are also deflationary forces such as falling housing/shelter prices, productivity gains (primarily from technological implementation), and lower energy costs (which is a foundational cost to all products and services).

Our claim is not that the current inflation environment is hunky-dory. It’s just not as bad off as many media outlets claim. Current inflation approximates long-term averages, yet is still above the Federal Reserve’s target. Clearly, more work needs to be done. The best inflation description is… elevated but controlled.

1Bureau of Labor Statistics, bls.gov

2Bureau of Economic Analysis, bea.gov

Recent Comments