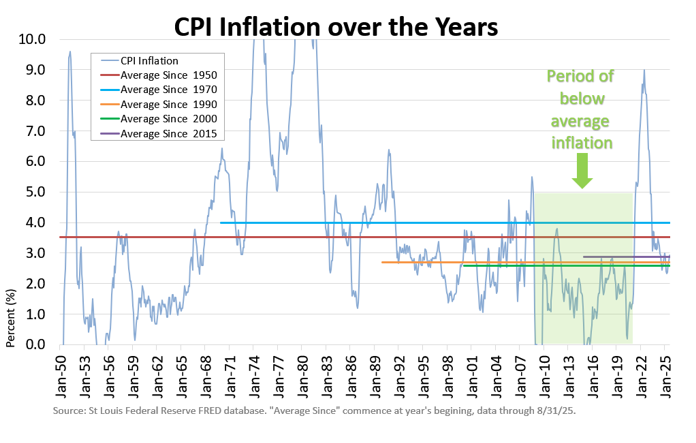

Last week’s newsletter spurred questions of “what caused the low inflation during the 2010s?” Excellent question, worthy of a follow-up. Our historical inflation chart has been updated to highlight the 2010s in green.

During the decade, economists and investment professionals were left scratching their heads. Many looked at short-term market dynamics, which missed the fundamental change that was afoot. The world has changed considerably in the

past five years, leaving the 2010s mostly forgotten. Yet, the true causes of the 2010s low inflation can be assigned to three fundamental forces: 1) China, 2) abnormally low interest rates, and 3) the inception of the “sharing economy.”

The China story starts in the 1970s. China was a poor country in per capita and absolute terms, mostly an agrarian economy with a commencing industrial revolution. China sought ways to increase wealth and was willing to take advantage of low wages. In 1992, Deng Xiaoping created Special Economic Zones, which received foreign direct investment and gave birth to “Made in China.” Fast forward to the 2010s, companies from around the world found their way to low Chinese wages to keep their products’ price competitive, as labor is often a high manufacturing cost. The 2010s became the heyday of Chinese manufacturing, especially for low-cost items. The result was that global consumer price increases were kept low as the labor costs remained contained.

In response to the Credit Crisis, the Federal Reserve (Fed) slashed rates to rock bottom… and left them there for much of the decade. Decades of economic practice proved that low interest rates keep the money spigots open, a much-needed valve during any calamity. Low interest rates percolate throughout the economy in different forms, but the end result is a low cost of capital/borrowing for business and consumers. The revved-up economy often results in higher inflation, but in the 2010s… it did not. (Some are still wondering why!) So, the Fed left rates at near 0%, hence there were minimal financial costs to be priced into products and services.

Lastly, the 2010s were the inception of the “sharing or gig economy.” There is no exact definition, but generally, it’s the peer-to-peer or crowdsourcing economy. Via technology, regular private citizens could ride-share, home-share, sell their wares, or pick up part-time work. Companies like Uber, Lyft, AirBNB, VRBO, eBay, Craigslist, Etsy, WeWork, and Zipcar allowed people to provide a service, sell a product, or share space at a fraction of the cost of the formal players.

There are still aspects present from the 2010s. Yet, the cost gains have likely evaporated, at least in the near-term. The formal players (like taxis and hotels) have adjusted their prices downward, and/or participants on Uber, Lyft, AirBNB, and VRBO have adjusted their prices higher. Interest rates are not likely to be reduced to near-0% again. China’s low wages have risen. Not to mention, China’s self-serving behavior during COVID ultimately worked against them as countries and companies have begun decoupling from “Made in China.” We hope this trip down memory lane helps answer questions from the 2010s.

Recent Comments