Asset Allocation may be the most boring investment strategy, but it has proven to be the most enduring and effective strategy. Over the decades, the investment management discipline has bifurcated into money managers and portfolio architects. Money managers are investment professionals singularly focused on security selection (i.e. stocks, bonds, derivatives, etc.). Portfolio architects, on the other hand, are engrossed in the overall portfolio design and execution.

The two, money managers and portfolio architects, work hand in hand to reach individual investor objectives. Portfolio architects focus on capital market research which helps develop the blueprint for an investor’s asset allocation. Money managers may conduct capital market research, but with the focus on which stocks or bonds to buy. (Interestingly, some money managers ignore capital markets as they feel capital market research provides little or no value to their security selection process.) Portfolio architects are more closely related to wealth management and financial planning. Portfolio architects tend to have a better understanding of the end client, risks germane to the client and view capital markets with longer investment horizons.

One aspect a portfolio architect needs to address is the concept of serial or sequential returns. Returns from one period to the next can have tremendous influence on the ultimate outcome. Specifically, return volatility reduces the reliability of targeted results. This is not to say that volatility should or can be avoided at all costs. Simply, volatility considerations need to be modeled with reasonable efforts.

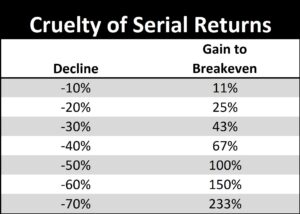

Math is not a favorite topic of most. But, the cruelty of sequential return mathematics should be recognized. In short, the larger the decline, the higher the return needed to breakeven. A decline of 10% only requires a return of 11% to breakeven, but a decline of 70% requires a return of 233% to breakeven. There is an exponential relationship of declines and the breakeven return.

Why is this important?

When developing investor portfolios, portfolio architects need to estimate returns for a client’s long-term objectives. The long-term is made up of short-term periods. Should a short-term period experience an excessive decline, subsequent periods would need to work harder to recover. This could mean taking on more risk which accompanies return variability with no guarantees. So, more risk at a time when additional risk taking may not be desired could be a disaster in the making.

A good command of sequential returns as well as capital market research and investor objectives are all important aspects of wealth-based portfolio management. As Albert Einstein said, “Compound interest [returns] is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

CRN-3274763-100720

Recent Comments