It’s hard to believe so many events could be packed into a single quarter. The quarter began in the midst of the COVID-19 pandemic while financial markets had already commenced their advance northward. Daily Coronavirus Task Force briefings had become all too familiar. Soon to follow were calls for an economic reopening as business owners and consumers became antsy. Although debate ensued, business reopening brought the perception that normalcy may be around the corner.

Progress towards COVID-19 containment allowed global citizens to focus their efforts on the origins of COVID-19. Investigations called into question negligent handling by the autocratic Chinese government. The US, with the highest number of infections and deaths to date, took the lead on Chinese criticism, which stained US-China relations and caused speculation of a new “Cold War.” Oddly, just a few months earlier the US and China ink a monumental trade deal. Not to mention, strong arming Hong Kong didn’t help China’s world standing.

Then… the George Floyd incident occurred, sparking US social unrest. Outside the US, peaceful marches ensued as a symbol of support and change within their own countries.

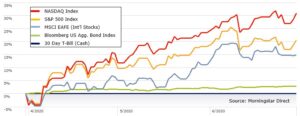

The economic, health and social rollercoaster did not have a major impact on financial markets. Financial markets bottomed around March 23rd and didn’t look back until early June. This was one of the quickest rebounds in US market history. So much so that the S&P 500 had its best quarterly return since 1998¹. Also, the technology heavy NASDAQ index notched an all-time high. This isn’t to say volatility was absent. The quarter did experience some capricious behavior.

Financial markets focused on the economic data looking for the slightest indication of future direction. This is likely to be the deepest, yet shortest recessions on record. The National Bureau of Economic Research (NBER) will likely date the recession between Feb. – Apr. May’s economic data (being released over the past couple of weeks) has shown heightened consumer confidence, explosive consumer spending and elevated business activity.

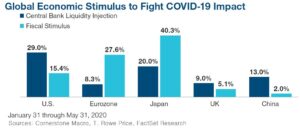

One should be careful of the conclusions or the direction of May’s data. The COVID-19 shutdown created an “artificial recession.” A recession not of its own volition, but an economy stymied by abnormal circumstances. The extraordinary global governmental actions (via monetary and fiscal policies) accompanied by increased consumer savings during the shutdown and warmer weather prompted consumers to satiate their spending desires. Even a shaken bottle of Champaign needs to alleviate its pressure. The question is, “will the direction of the May data endure?”

There are some indications that May is not an aberration. Early June data is following a similar trajectory, but caution should be noted. The concern of a second COVID-19 wave seems to be coming true. Yet, better viral understanding and infection knowledge makes a draconian shutdown unlikely. COVID-19 is also rearing its ugly head in Latin American and Southern Asia, emerging markets that often supply raw materials and/or manufacturing capabilities.

To compound risks, social unrest has not abated. Financial markets have mostly ignored these events. Should protest and unrest impact companies’ bottom lines, the financial markets may react negatively.

With the second quarter’s end in sight, volatility perked up. Volatility is a natural aspect of financial markets, especially during a consolidation phase. During consolidation, markets can seemingly act erratically, but it is the needed pause for markets to reflect on the recent upswing. Understandably, volatility can lead to investor anxiety even if volatility is a normal trait.

These themes are likely to continue with the addition of a few others. Most notably is the upcoming 2020 presidential election. In the coming months, media outlets will inundate US citizens with campaign advertisements and showdowns. Some will even proclaim themselves a soothsayer. If history is a guide, presidential elections have some, but manageable impact to market volatility.

As we exit the second quarter and enter the third, cautious optimism abounds. Fundamentals are clearing showing signs of improvement, although not evenly across all industries. Amid the potential risks of a COVID-19 resurgence, social unrest impact, US-China tensions, presidential election volatility and delayed employment prospects, a broadly diversified portfolio is the best approach.

The months and years ahead will likely bring more challenges and opportunities. We will be here to help.

¹“U.S. Stock Futures Slip After S&P 500’s Best Quarter in Over 20 Years” Wall Street Journal, July 1, 2020

The S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. NASDAQ Index measures the performance of the 100 largest non-financial securities listed on The NASDAQ Stock Market.

CRN-3147403-070120

Recent Comments