Out with the old and in with the new. A new year offers the opportunity to begin again. This couldn’t have been truer than the first quarter 2021. The first quarter had a raucous beginning, but settled down as a new administration took hold, COVID vaccine dissemination improved, and the economic backdrop recovered. Financials markets took their lead from improving fundamentals and a promised COVID support package. Although the support package was approved far later than expected, it did arrive.

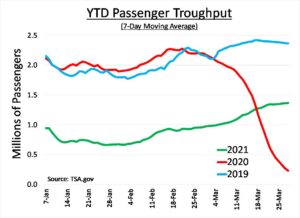

Improving fundamentals stemmed from three sources. The first is the COVID vaccine dissemination. Nervous anticipation accompanied the initial mass inoculation efforts. As time progressed, vaccine coordinators found better footing and the process improved. Mid-to-late March encountered vaccination stories and anxiety relief. Inoculation efforts furthered individual’s and business’ confidence that the end to COVID impediments may be near. A glimpse of the future is likely to see a “future normal” being a combination of the pre-COVID normal laced with virtual efficiencies exploited during COVID.

Secondarily, abnormal seasonal effects weighed into the quarter’s happenings. The polar vortex bought a deep freeze reminiscent to the 2004 Hollywood movie The Day After Tomorrow. The freeze spread to chill economic data in the early quarter. The eventual thaw contributed to the already present COVID induced cabin fever and pent-up demand.

Fulfilling pent-up demand can be observed through high frequency data. These include items such as Transportation Safety Administration’s (TSA) passenger throughput or restaurant table reservations from Open Table1. Likewise, newly announced cruise ship voyages are selling out in weeks2. Unless something out of left field presents itself, 2021 seems to be shaping up to be a very good economic year.

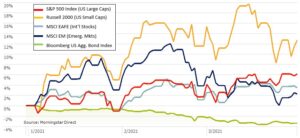

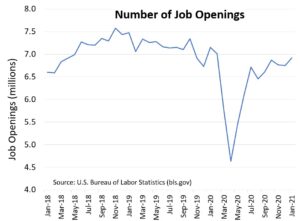

Inoculation freedom and welcoming Spring alone was enough to propel economic activity making the Federal Reserve’s (The Fed) highly stimulative policy icing on the cake. Interest rates have purposely been kept near zero to stimulate consumption, further the business cycle and encourage companies to explore value-add projects and hiring. All of this should be accretive to company earnings, which drive stock prices higher. One note of caution is U.S. stocks valuations are considered high, specifically growth style companies and especially within the larger cap space. Any correction is a natural aspect of investing and should not surprise investors.

Longer term bond yields started to creep up. Longer-term yield increases were based on improving economic fundamentals and reaction to precursory signs of inflation. Since, bond prices are inversely related to yields, bonds gave up some of their unexpected 2020 gains. It is important to note that overall bond yields continue to be extremely low and precursory inflation signals have not yet influenced broader inflation numbers. Labor market slack, demographic trends and technological implementation are likely to keep inflation in check.

There is no doubt that COVID inoculation has been the primary economic driver and international data reflect this thesis. Countries with steadfast efforts have been quicker to open their economies3. Israel and the UAE are the best examples. Countries which have botched vaccination rollouts have been punished, which can be seen across Europe. Many missteps (bypassing highly vulnerable populations, not securing vaccine supplies, heads of state discouraging vaccination, unnecessary logistical bottlenecks, etc.) proved to slow their economies. Luckily, many countries have recognized the error of their ways and have made adjustments. A benefit to investing internationally is low stock valuations are often a long-term winning strategy and this area presents a lot of opportunity for investors.

The first quarter was likely the beginning of the end. The light at the end of the tunnel appears more and more like the culmination of the tunnel and not a second train barreling down the tracks. Inoculation struggles are evidenced in many places; yet mistakes are being righted, efforts have improved and the near-term has a very positive outlook. The two global economic engines (U.S and China) are performing well, all things considered, with a high probability further acceleration.

Investment management is not simply looking through rose colored glasses, but maintaining a vigil eye for risks near and far. Near-term U.S. risks are mainly focused on stock valuations and interest rate increases. Non-U.S. risks center around a timely COVID inoculations. Over the very long-term are the ramifications stemming from the tremendous amounts of debt incurred by many nations. Continually printing money is not a healthy long-term strategy. Economic theory will certainly be tested. Likely, new tools will be developed to combat future challenges.

We believe one of the most important tools we have as advisors is an examination of what we can control. We can’t control who is elected or the laws they will pass. We can’t control pandemics, interest rates, or investing fads. There are, however, many things we can control. Together, we can control your portfolio allocation and investment selections. We can control how we approach the balance of risk versus your goals. And we can control how we react to certain events and the media coverage of those events. In the end, those seemingly simple things can make a big difference.

CRN-3536471-040621

Recent Comments