“Transition.” That’s the best word to describe the third quarter of 2021. The exuberant recovery gave way to a rational recognition that the raging spending couldn’t last forever. The second quarter was consumed with COVID-cave emersion and spending to hearts’ delight, and just like any party, it must come to an end. The third quarter was met with levelheadedness of a more balanced lifestyle. This isn’t to say the good times are over, just that the easy carefree days are behind us now the real work begins.

“Transition.” That’s the best word to describe the third quarter of 2021. The exuberant recovery gave way to a rational recognition that the raging spending couldn’t last forever. The second quarter was consumed with COVID-cave emersion and spending to hearts’ delight, and just like any party, it must come to an end. The third quarter was met with levelheadedness of a more balanced lifestyle. This isn’t to say the good times are over, just that the easy carefree days are behind us now the real work begins.

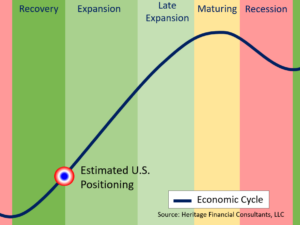

The COVID recession precipitated an extremely sharp economic decline absent typical economic exhaustion. Likewise, the recovery and the current transition to a sustainable expansion are also marked with atypical economic markers. The expansionary phase is often accompanied by low inflation, neutral interest rates, stable bond markets, strong equity markets as well as increasing business and consumer confidence, to name a few. But this go-around, most of these characteristics are absent, moderating, or contrary to typical markers. Hence, thinking outside the box has become the only normal analytical context.

The COVID recession precipitated an extremely sharp economic decline absent typical economic exhaustion. Likewise, the recovery and the current transition to a sustainable expansion are also marked with atypical economic markers. The expansionary phase is often accompanied by low inflation, neutral interest rates, stable bond markets, strong equity markets as well as increasing business and consumer confidence, to name a few. But this go-around, most of these characteristics are absent, moderating, or contrary to typical markers. Hence, thinking outside the box has become the only normal analytical context.

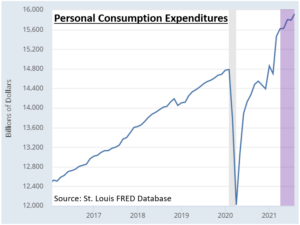

Economic growth fluctuates throughout the cycle. The recovery phase experiences explosive growth which gives way to a more stable growth trajectory. The downshifting to more sustainable growth was clearly evident in the third quarter. Personal consumption, often a precursor to boarder economic change, began slowing toward the end of the second quarter and continued into the third. Changing consumption behavior was a good indicator of a more viable tend and shift to a new economic phase.

Just when the prospect that COVID was nearing an end, a more infectious Delta strain exerted a similar economic uneasiness. As the Delta variant infection grew, so did the restriction recollections of the prior year. Return to work, return to school or further leisure endeavors were contemplated adding to reduced consumption. The arrival of Delta also coincided with a conclusion of summer vacations. Hence, the summer party of pent-up demand had concluded via satiation, Delta caution and/or a return to normal lifestyles.

Just when the prospect that COVID was nearing an end, a more infectious Delta strain exerted a similar economic uneasiness. As the Delta variant infection grew, so did the restriction recollections of the prior year. Return to work, return to school or further leisure endeavors were contemplated adding to reduced consumption. The arrival of Delta also coincided with a conclusion of summer vacations. Hence, the summer party of pent-up demand had concluded via satiation, Delta caution and/or a return to normal lifestyles.

The Federal Reserve (Fed) has been communicating its intention to reduce and ultimately eliminate monetary support. The Fed employs two methods to maintain a low interest rate environment, one method by open market bond buying. In such a capacity, the Fed acts like any other bond investor, albeit with near-limitless resources, artificially suppressing long-term interest rates. This is similar to holding a beach ball below the water’s surface. Releasing the beach ball at once could cause disruption. The trick is to release the beach ball slowly as not to disrupt the water’s surface. Broadcasting intent in advance as well as slowly releasing the monetary support should let rates rise to a natural equilibrium in a controlled and safe manner. The Fed has zeroed in on the fourth quarter to begin releasing monetary support.

INFLATION

Inflation transitioned from the second quarter’s torrid pace to a more tepid pace, though elevated, in the third quarter. Much of the transitory inflation has dissipated. However, stubborn supply chain effects continue to plague the world’s economies and adds to longer-term inflationary pressures. The prospect of higher inflation has entered the public discourse with a distant recall of the 1970s stagflation. Oddly, an “elevated” 2.5% – 3% inflation is still below the long-term norm. 1.5% – 2% inflation realized over the past 12 years is actually the abnormality people have become conditioned to accept as normal.

EQUITY MARKETS

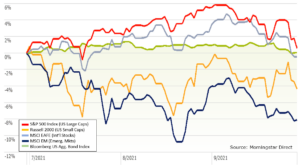

Equity markets also experienced a transition from enthusiastic appreciation to more levelheaded expectations and culminated in September’s increased volatility. Although larger U.S. stocks maintained their leading position, ultimately U.S. large caps couldn’t escape investors’ concerns. News of China’s Evergrande potential default gave investors enough reason to focus on other headwinds, such as the Fed’s admission that inflation has more enduring aspects, the economic phase transition and the Fed’s bond taper preparation.

The more-risky areas of smaller U.S. companies and emerging markets led the decline through much of the third quarter with the larger and more established brethren of the U.S. and international variety following suit. Much of the emerging market decline was attributable to the performance of Chinese stocks due to increased regulations and new government policies spooked investors. China makes up about a third of the emerging markets index and accounts for the index’s poor third quarter performance.

FIXED INCOME MARKETS

Fixed income markets didn’t escape investor worries. In reaction to similar stimuli as the equity markets, fixed income markets saw flat returns for the quarter. The most worrisome issues are the future inflationary levels as well as questioning the Fed’s ability not to disrupt bond markets during its tapering efforts. On the positive side, bond default rates have plummeted providing some fodder for narrow credit spreads. Low defaults rates typically accompany the economic cycle’s expansion stage.

The downshifting moderating economic data, higher valuations, and the near-term Fed tapering has given investors reason to hit the pause button in the third quarter. The previous five quarters of strong market returns with minimal volatility may have erroneously trained investors to believe the normality of declines no longer applied. We’ll continue to monitor financial markets with your best interest in mind. Please reach out if ever need to chat about your portfolio.

The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp. The S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. NASDAQ Index measures the performance of the 100 largest non-financial securities listed on The NASDAQ Stock Market.

CRN-3861473-101121

Recent Comments