Financial markets greeted the 2023 with enthusiasm as investors bid good riddance to 2022 and looking forward to the Federal Reserve (Fed) exiting their heavy-handed authority. The first quarter of 2023 was a bit of a roller coaster ride. January’s climb seemed like a kiddie ride due to muted volatility, but investors eventually realized it was the initial climb of an adult ride with a swooping drop.

The quarter’s second month turned against stocks and bonds. Dreams of unencumbered financial markets didn’t last long as the Fed reinjected hawkish remarks due to inflation data not succumbing to the Fed’s desires. Investors retreated as a 2022 repeat spooked investors’ confidence. The Fed’s months long message of an eventual pause, long craved by the markets, looked to be in jeopardy.

Fed Chairman Powell’s semiannual monetary policy report to Congress on March 7th and 8th was the pinnacle of such hawkish talk1. Powell’s higher rate intent did not last long as the first financial casualties were announced days later. Silicon Valley Bank failed on March 10th and Signature Bank failed on March 12th 2. Aggressive and narrow banking relationships were the primary culprit, however the fastest interest rate increase in history certainly contributed to the failures. With recollection of the ’08-’09 Credit Crisis, government officials (specifically, U.S. Treasury Secretary Janet Yellen) rushed to remind depositors of FDIC insurance and assured federal government backstops could be utilized. Crisis averted.

Realizing potential culpability and economic fragility, Powell quickly reversed his hawkish posture returning to his initial near-term rate pause stance. Financial markets applauded Powell’s flexibility closing the quarter on a positive upswing.

The geopolitical environment had a few outstanding predicaments. Most notable was the eruption of high-altitude floatable observation platforms, at least one of which was a Chinese spy balloon4. Others look to have been more benign scientific balloons. China has moved forward with its proclamation to replace the U.S. as the sole super-power, which requires miliary and economic superiority. On the economic side, China has made their latest chess move establishing the Petroyuan for Saudi oil exports to Russia and China. China’s slow and methodical march to become the world’s super-power continues. Any counter chess move falls on the U.S. Though not likely to have immediate investment repercussions, China’s aspirations are on the radar as a long-term risk.

INFLATION & RECESSION

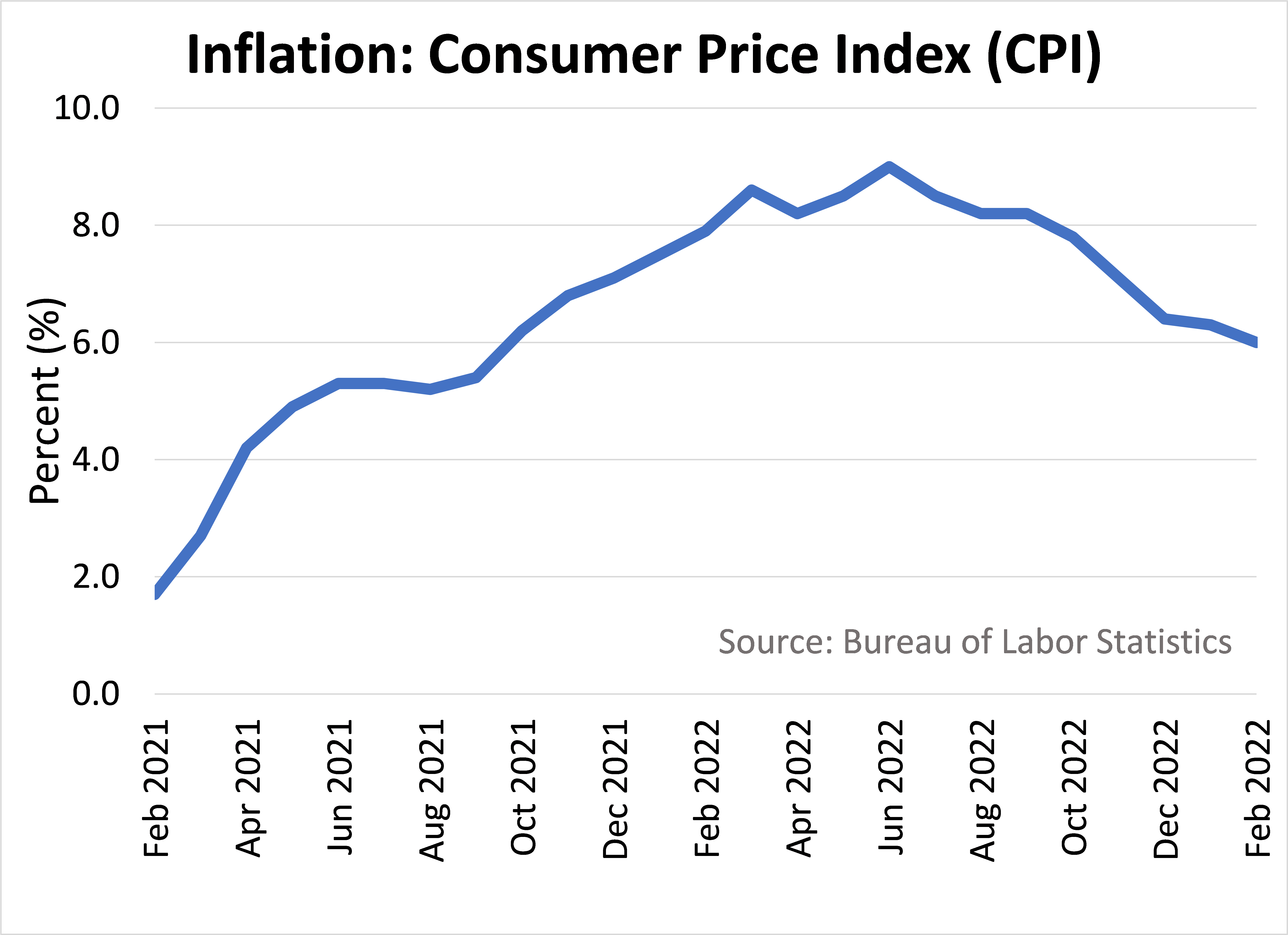

Financial markets remain focused on the two primary risks, inflation and recession. Inflation has clearly passed its zenith and has begun its journey to a normalized zone. The journey is not a fait accompli with obstacles yet to be overcome, but inflation is on a downward path. Inflationary pressures remain within agriculture, energy and labor markets.

Fed Chairman Powell’s action to tame inflation has come at the increasing risk of recession. To economic wonks, recession has always been an unwanted yet likely outcome. After all, inflation is the product of too much money chasing too few goods. In order to ease inflation, the Fed has to inhibit cash chasing those goods, in other words… slow people’s spending cravings. Slowing spending is slowing the economy. Given the delayed and imprecise nature of economic relationships, economic slowness can result in recession.

EQUITY MARKETS

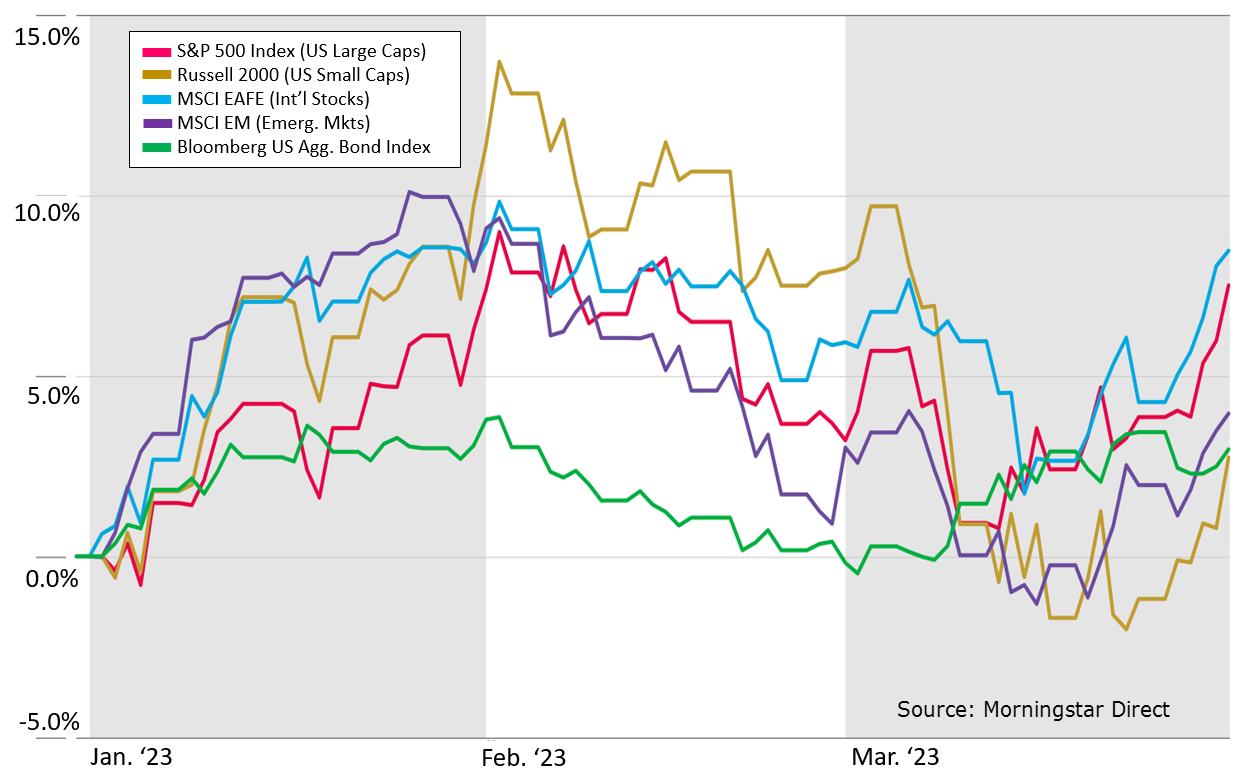

Even with the quarter’s roller coaster ride, equities were able to muster positive returns for the quarter. Equity asset classes reached their quarterly peak after the first month. Riskier smaller companies and emerging markets led the early advance, yet also led the mid-quarter decline. The early March bank failures were a clear indication the Fed needed to proceed judiciously with a likely near-term rate pause propelling growth-oriented equities in the quarter’s closing weeks.

Giddy stock investors seemed more focused on the newly forecast Fed rate pause and eschewed recession probabilities or subdued earnings. The quarter’s stock market advance brought stock valuations in-line or above historic norms, which could lead to future volatility. As a reminder, volatility is built into capital market assumptions.

FIXED INCOME MARKETS

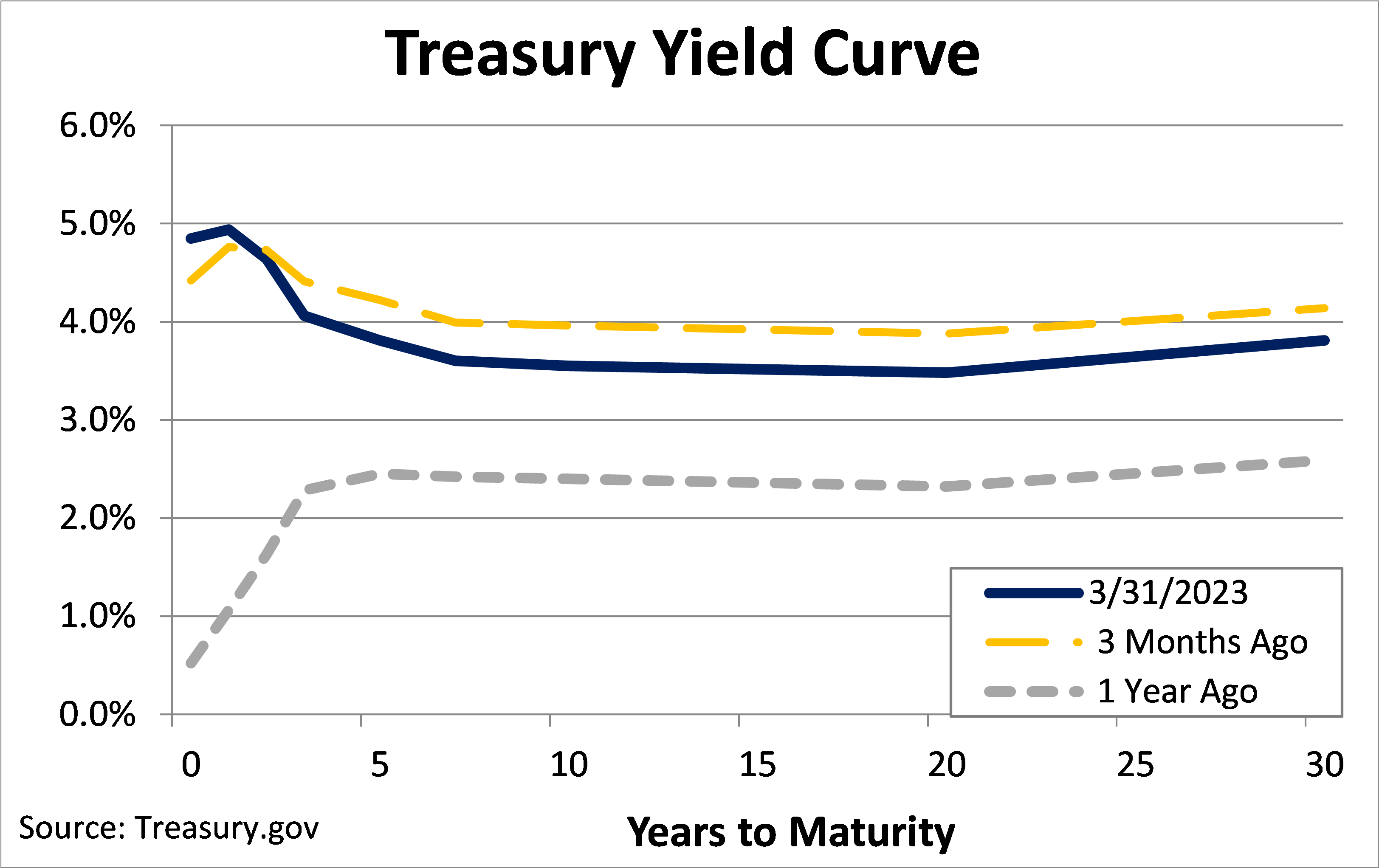

Fixed income markets enacted an about face upon the previously mentioned bank failures. Post bank failures, fixed income market concerns switched from Fed action and to impending recession. Flight-to-quality due to economic duress is the norm as investors move dollars to move secure vehicles. Closer maturities continue their ascent as the Fed raises rates, yet investors’ demand for longer dated bonds drove those prices higher and yields lower. (Bond prices and yields are inversely related.) Yield curve inversions, initiated in Q4, give credence to mounting recession pressures.

As investors, we typically focus on returns. How much did I make or lose? But at its heart, financial markets are squeamishly focused on risk, hence the volatility. Risk is exposure to the consequences of uncertainty. Returns are simply the outcome. Risk comes in different forms; economic, volatility, cash flows, competitors, suppliers, political, geopolitical, policy, etc. The first quarter was a very good example of the various risks, expected and unforeseen, being observed in a relatively short period.

Portfolio development and implementation recognizes risks cannot be ignored, nor can they be fully avoided. The nature of investment is dealing with acceptable risks to gain exposure to the returns they produce. Until our next meeting or conversation, have a wonderful spring, you earned it.

1https://www.federalreserve.gov/newsevents/testimony/powell20230307a.htm

2https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/

4https://www.usni.org/magazines/proceedings/2023/march/spy-balloons

The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp. S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. Russell 2000 measures the performance of US small cap stocks. MSCI EAFE measures the performance of large and mid-caps of developed markets excluding the US and Canada. MSCI EM measures the performance of the large and mid-caps of emerging market equity securities. Bloomberg US Aggregate Bond index measures the performance of US investment grade bonds, including Treasuries, government agencies, corporates, MBS and ABS. CRN-5614838-041023

Recent Comments