The U.S. economy has shown overall weakening in the third quarter. Manufacturing has contracted, consumption has slowed, and labor markets are showing signs of moderating. The Unemployment Rate ticked higher accompanied by few available jobs and surging job strikes2. Softening labor markets also led to softening work-from-home demands.

The global economic landscape faces challenges. The European continent has the markings of recession while China, the world’s second largest economy, has disappointed on many fronts. Beyond domestic fiscal trepidation and secular demographic challenges, the rift between China and western powers is causing opportunity elsewhere. Though many Asian nations are benefiting from western company relocation efforts, India and Mexico seem the best positioned. India has risen to the world’s most populous country with young and willing workers as well as needed infrastructure buildout along with intellectual property rights which China eschews. During the third quarter, Mexico was recognized as the U.S.’s top trading partner replacing China and surpassing Canada3. Credit goes to manufacturing relocation efforts, 2020 US-Canada-Mexico Agreement, and China’s contentious conduct.

Geopolitical events have remained relatively measured. Russia-Ukraine has mostly been a stalemate throughout the quarter. Chinese aggression in the East and South China Seas have quieted. At the same time, many Pacific nations are building military strength while creating a Pacific coalition, specifically Japan, Philippines, and Vietnam. The Russia-China alliance has grown to include North Korea and Iran. Geopolitics is a never-ending game of chess but could have real world investment implications.

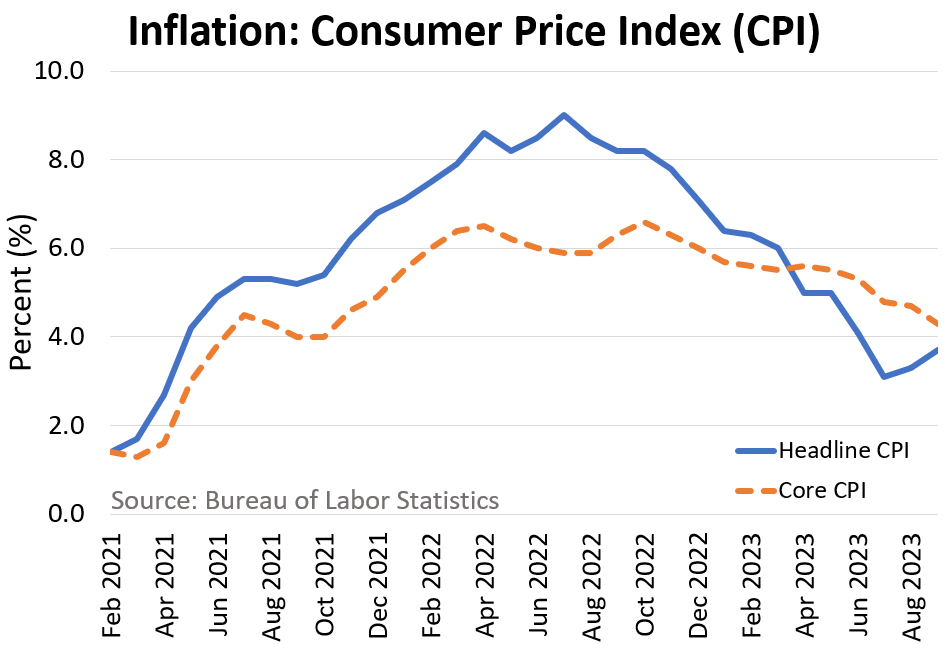

Inflation peaked in the summer or 2022 with a precipitous decline since. Headline inflation can be tainted by near-term food and energy instability, leaving the Fed to deliberate on Core Inflation. The Fed felt investors should not take solace at current levels or the deliberate progression opting for another rate hike in July. The recent upward jaunt is a product of unsustainable gas prices and calculation idiosyncrasies. Having said that, move to the Fed’s target may be choppy going forward. As reminder, the Fed’s full impact has yet to be felt.

EQUITY MARKETS

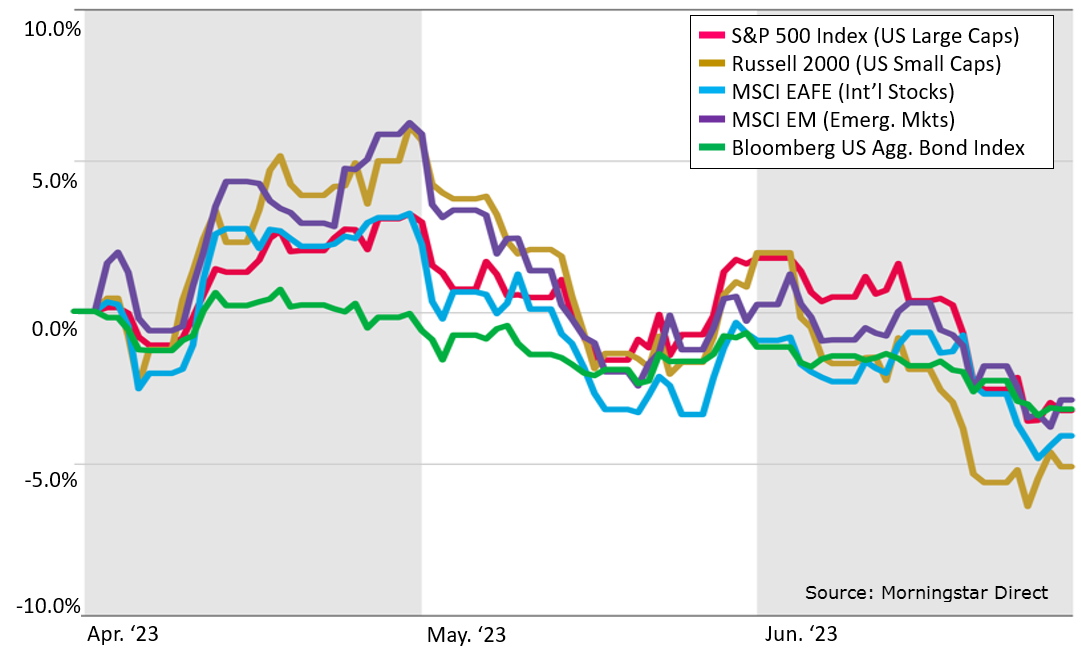

Equity markets experienced a bit of a rollercoaster ride in the third quarter. Spirits were riding high through July’s end to intra-year highs only to retreat from those levels. All equity classes ended with a negative quarterly notch.

U.S. larger company stocks, as measured by the S&P 500, appeared to have the best performance. The large cap return was obfuscated by the “Magnificent 7” stocks which drove much of the index. A more appropriate S&P 500 Equal Weighted measurement (a healthier overall measure of large cap stocks) showed large caps to be one of the worst performers. U.S. investors of foreign securities experienced a deleterious effect from the rising U.S. dollar, which climbed to new intra-year highs.

Falling global stock prices established more reasonable U.S. valuations and even favorable international stock valuations, especially in Europe. Stocks wrestled with uncertainty introduced by the Fed in the third quarter and ended the quarter confronting new uncertainties of a government shutdown, building recessionary pressures and geopolitical events. It is important to note that stocks, though influenced by the economy, are not economy proxies. Stock values are ultimately based on revenue generation, cost control, and the ability to generate earning

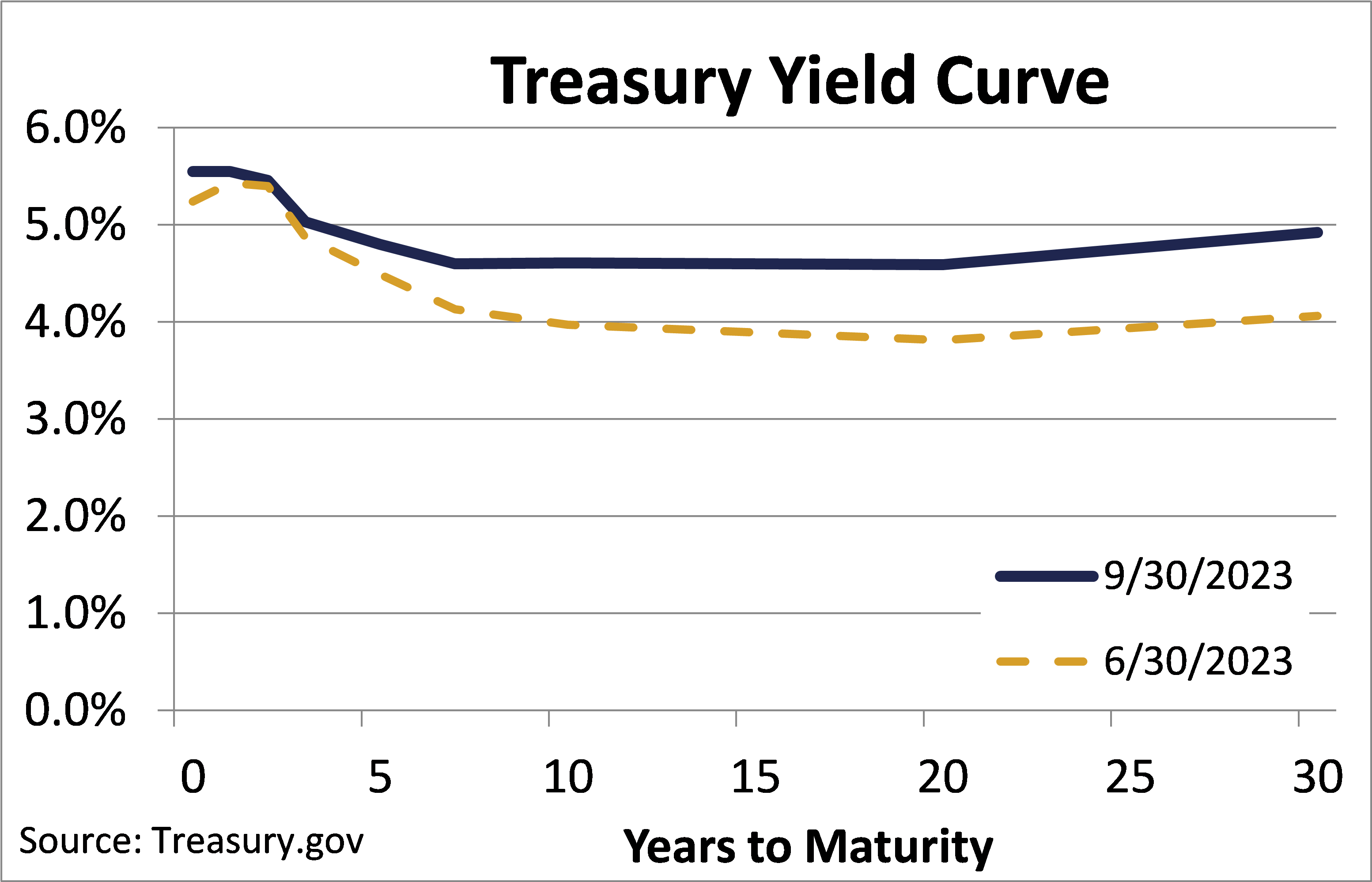

The Fed’s decisions are not isolated to the equity markets but also effected the fixed income markets. Most bond classes saw their positive first half returns negated in the third quarter. Low credit quality bonds remained in the mid-single digit range. Mounting credit risks on top of elevated high yield bond valuations may introduce adverse effects going forward for low credit bonds but lay a desirable footing for higher grade bonds.

The third quarter suffered from some zingers thanks to Fed surprises. The lagged effect of rate changes has tamed inflation, softened labor markets and dampening the economy. Yet, the foundation may have been laid for favorable high grade fixed income markets and select equity markets. Remember, the best way to address your objective is a well-diversified portfolio. Please enjoy the next quarter with holiday cheer.

1 Federal Reserve

2 https://www.wsj.com/business/the-u-s-lost-4-1-million-days-of-work-last-month-to-strikes-92c6a9f7?mod=mhp

3 https://www.dallasfed.org/research/economics/2023/0711?stream=business

4 St. Louis Federal Reserve FRED database

The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp. S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. Russell 2000 measures the performance of US small cap stocks. MSCI EAFE measures the performance of large and mid-caps of developed markets excluding the US and Canada. MSCI EM measures the performance of the large and mid-caps of emerging market equity securities. Bloomberg US Aggregate Bond index measures the performance of US investment grade bonds, including Treasuries, government agencies, corporates, MBS and ABS. CRN-5989929-100223

Recent Comments