The Federal Reserve (Fed) followed through

with their promised rate cuts. The first rate cut coincided with the third quarter’s close. The Fed began their rate cut cycle with an exuberant 0.50% cut in September1 followed by two 0.25% cuts in November and December for a total 1.00% rate reduction by year’s end1. However, during the Fed’s final meeting for 2024, Fed Chairman Powell tempered forward rate cut expectations for 2025, which contributed to a decline in the stock and bond markets in the final two weeks of 2024.

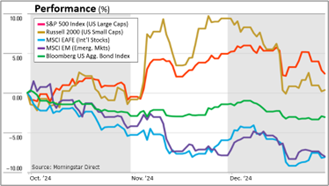

October, the last full month leading to the election, saw typical election year oscillation that concluded with a post-election relief rally. A relief rally is a natural tendency as political “uncertainty” exits investor concerns. President-elect Trump’s pro-business policies via reduced regulation and a move closer to a laissez-faire economic model prompted investor attention.

European economies’ early 2024 momentum gave way to softness. Europe’s main economic engine, Germany, has been sputtering as of late. Much of Germany’s economy is driven by the automotive industry which is embroiled in the global automotive demand downturn. Global automotive manufacturers, including Germany’s mainstream and luxury brands, have been confronted with massive cost reduction efforts, including idling factories and laying off workers. (Japan’s Nissan is on the verge of bankruptcy should recent merger talks with Honda not produce fruitful plans.) Europe’s outsized service sector, which includes tourism, has kept their economies on the positive side of growth.

Most developed nations viewed the December’s geopolitical change positively. Long time Syrian dictator, Bashar al-Assad, fled Syria after a 50-year Assad family rule2. A Syrian civil war raging since 20112 accentuates populace dissatisfaction. Though Syria has de minimis direct investment impact, its Mid-East orientation could have extended ramifications. We will continue to monitor this situation.

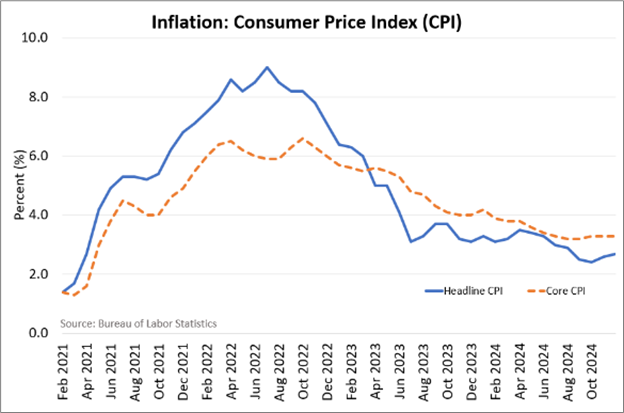

INFLATION

Inflation is in a moderate and controllable range approximating long-term averages. More recent inflation prints, measured by the more popular Consumer Price Index (CPI), has shown stubbornness as of late. This is mostly attributable to the heavily weighted shelter component which has a natural lagged effect. The Fed’s preferred inflation measure, the PCE Price Index, has shown a continued desirable downward trend.

The recent mixed inflation releases were the primary reason Fed Chairman Powell suggested a less dovish interest rate cut outlook, leading to financial market decline towards the end of December.

EQUITY MARKETS

A subdued October gave way to a post-election romp. Smaller company stocks took the initial lead but ultimately succumbed to US large-cap growth stocks, specifically the Magnificent 7. The deflating pinprick of small company stocks was the Fed Chairman Powell’s comments previously mentioned. Smaller companies are more sensitive to financing pressures and rates than their large brethren. The regained lead of larger growth stocks has pushed elevated valuations into frothy territory. Though valuations are not a precursor to a stock market decline, higher valuations do make those stocks more sensitive to news that falls short of expectations.

International stocks gave back much of their returns established through the third quarter. The fourth quarter’s underperformance was due to a combination of a softening European recovery, post-election interest in US stocks (pulling investable dollars from foreign stocks), and an appreciating US dollar (hence, depreciation of foreign currencies). Pessimism has been priced into foreign stocks, especially European stocks, making them ripe for a turnaround.

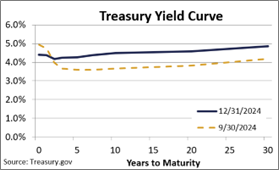

FIXED INCOME MARKETS

The fourth quarter of 2024 saw continued volatility in the fixed-income markets, driven by investor concerns over inflation and central bank policies. In the United States, Treasury yields remained relatively elevated as the Federal Reserve maintained its

cautious approach to monetary policy. With inflation still above target levels and a strong labor market persisting, market participants continued to price in the possibility of higher-for-longer interest rates. This environment put pressure on intermediate and long-term bonds, as rising yields decreased the attractiveness of these securities. The demand for safe-haven assets remained robust, but corporate bond markets saw more selective buying, with high-quality issuers performing better than riskier counterparts due to ongoing economic uncertainty.

Internationally, fixed-income markets also grappled with a challenging backdrop of geopolitical tensions, inflationary pressures, and central bank decisions. In Europe, the European Central Bank (ECB) has executed a more aggressive rate-cut cycle, battling their softening economies with a more favorable inflation picture. The Bank of England, commandeering a more robust economy, has reduced rates more cautiously. The biggest factor in the international bond decline is the appreciation of the US dollar or the decline of foreign currencies. Our international bond position hedges against currency changes, creating a positive return for our portfolios.

CONCLUSION

With 2024 behind us, we feel cautiously optimistic about the stock and bond markets in 2025. Stubborn inflation elevated US stock valuations, the impact of a new presidential administration, and geopolitics all present wild cards that shouldn’t be ignored. But, the backdrop of low unemployment, a resilient consumer, a Fed committed to lower interest rates, and growing AI-based efficiencies could create upside potential for stocks and bonds.

CRN-7505900-010725

Recent Comments