Are we watching a Hollywood movie? The dramatic political swings seem ripe for a bucket of popcorn in a dark theater. A polarized electorate, candidate court trials, bumbling debate performance, assassination attempt, existing president’s last-minute withdrawal, global computer complications, and we are still three and a half months from the election with the infamous “October Surprise” yet to occur. Are we living the latest installment of The Matrix? Will Neo (Keanu Reeves) survive to wipe out the computerized overloads, or will the Manchurian Candidate (Denzel Washington) be called into action to disrupt political discourse? Those predicting an eventful summer have certainly hit the nail on the head!

Every four years, candidates and campaigns exclaim the “most important election of our lifetimes,” often suggesting country dissolution should a party’s prescription not be filled. Yet, the ebb and flow of political change is the norm. Elected officials naturally change due to the electorate’s shifting priorities, preferences, and challenges, much like a pendulum swinging back and forth. Still, the country endures thanks to the deliberate decentralized power and purposeful sluggishness of the legislative process designed by the founders as they envisioned a government different from a tyrannical monarchy.

Those principles have permeated throughout much of our free market economy. Companies must recognize the shifting of governmental policies as just one of the many aspects in need of consideration. Corporate chieftains have a long list of risks, pressures, and challenges to capitalize on opportunities. Economic phase, competition, raw material supply, shifting consumer preferences, labor demands, expense control, interest rate direction, and product development are a very short list of considerations.

As for investing, it is important in the long game. As a wise economics professor said, “permanency is a product of one’s time horizon.” The cost of raw materials is in a state of flux. Buildings and factories can be built or razed. People can be hired or laid off. Products and services must be improved to remain relevant. Governmental personnel and policy shifts are the norm. All are temporary. If one’s time horizon is a day, everything is permanent. Elongate your horizon to a decade, and almost everything can be adjusted.

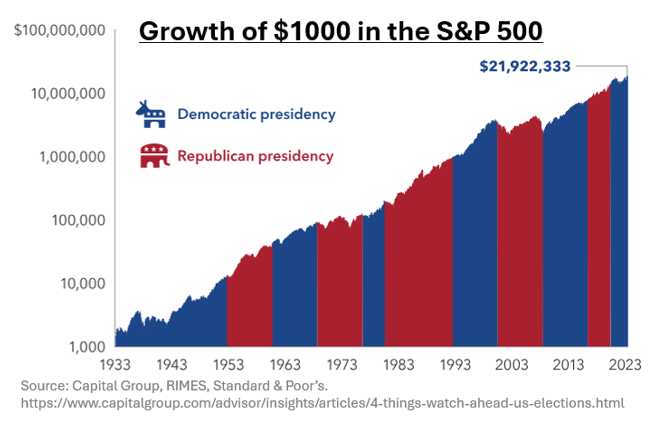

Stocks, in aggregate, have performed well over the long term, irrespective of which political party is in the White House. Companies have the flexibility to explore new revenue sources, change the prices, and control costs. At the end of the day, stock values are based on earnings which transcends politics. It is tempting to equate political sentiment with investing success, but it is wise to suppress such an inclination.

We said it before, uncertainty is the market’s kryptonite. As we progress through the next few months, political uncertainty may prompt volatility. A temporary effect. Don’t let temporary dislocation disrupt your long-term goals.

S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market.

The opinions expressed are those of Heritage Financial and not necessarily those of Osaic FA.

CRN-6822414-072324

Recent Comments