What will happen to the US dollar? A question on people’s minds after Moody’s recently downgraded US credit rating, which noted the size of US debt.

Clearly, the US debt has increased significantly over the past 17 years. Rollback 17 years to the Credit Crisis, which turned into the Great Recession, the worst economic period since the 1930s Great Depression, for the first sizable monetary injection. The next cash infusion came during the recent COVID period. Both extreme events required a massive influx of liquidity to keep the financial markets from freezing and assist citizens with their bills.

With all this Federal debt, a natural concern is, “Will the US Dollar lose its world reserve currency status?” Before answering that question, we need to level-set. Most developed nations have debt higher than their GDP. In other words, most developed countries owe more than their annual income. Japan being the worst offender, with around 230% of debt-to-GDP. Japan has been above 125% (the current US debt-to-GDP) for almost 30 years! The point is the US is not alone, nor the worst offender.

Second, in order to entertain a world reserve currency replacement, there has to be a viable alternative. Upon review of the currency landscape, there is nothing in sight. The Euro was Europe’s attempt to challenge the Dollar’s supremacy but failed due to a lack of a cohesive political structure and European countries pursuing different fiscal and monetary objectives. The Chinese Yuan was the latest failed attempt as China lost global trust (much due to their actions during COVID, which also uncovered their dubious Belt-and-Roads initiative), a paramount characteristic for financial transactions. Not to mention, China’s secular stresses, such as unfavorable demographics and foreign investment exodus, threaten to weaken China’s economic prowess.

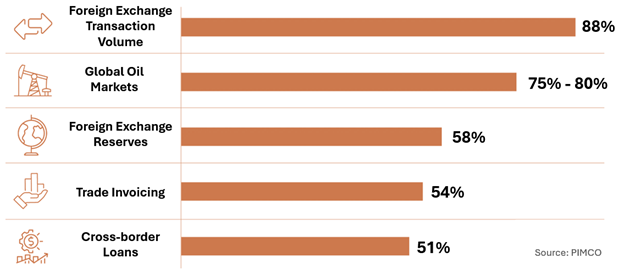

The US Dollar is backed by the largest global economy. The US economy is about 25% of the world’s GDP. The US economy is the most diverse of any country. The US has never defaulted in its nearly 250-year history (which includes internal strife, wars, various economic upheaval events, etc.), a feat no other developed country can claim. Yet, the US has fulfilled its financial obligations. Countries and companies have come to have such trust in the US Dollar so much that the majority of international transactions are denominated in US Dollars, even transactions that do not involve the US.

So, will the dollar be replaced as the world’s reserve currency? In our lifetimes, it is highly unlikely… barring an unforeseen catastrophic event. This isn’t to say the current US debt load is problem-free. High debt levels could impede growth, restrict the US’ ability to react to future calamities, and curtail promises made to future generations. As we enter the July 4th weekend, be leery of talk suggesting the US Dollar’s demise… they are trying to sell you something. Happy Fourth!

Recent Comments