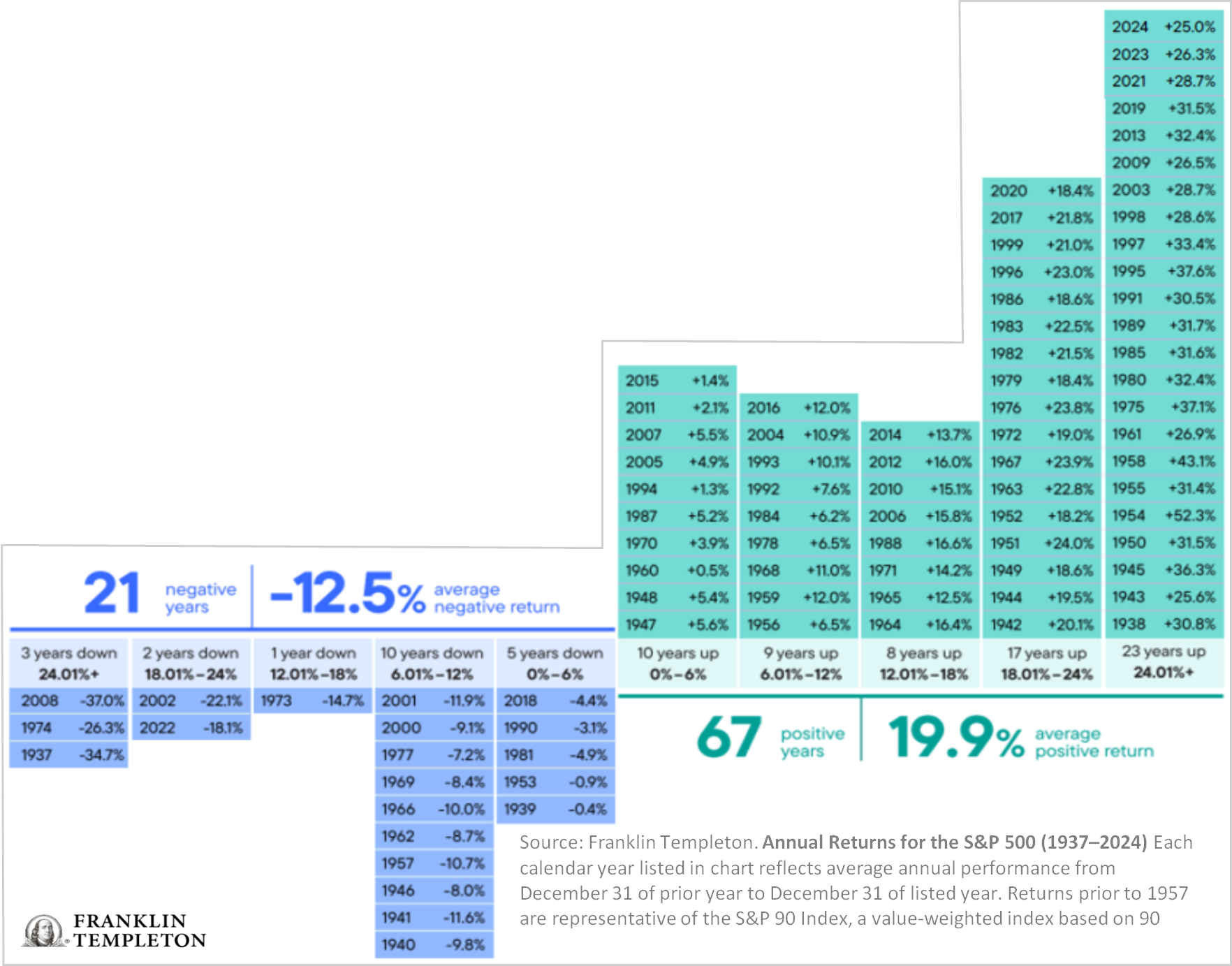

Three steps forward, one step back. If you were ever curious about what to expect from the market, this is a way to describe what the stock market has delivered. Three steps forward, one step back has remained rather consistent over the years. The graphic reflects the S&P 500 (and S&P 90 prior to 1957) annual returns between 1937 and 2024.

Beyond the three-step one-step shuffle, there are other observations that play into the statistical record. The average positive return is 19.9%, versus the

average negative return of -12.5%. Hence, more upside potential than downside pain. Taken together, there are more positive years with higher upside potential. The average return for all years hovers around 10%.

Unfortunately, the downside arrives unannounced. In order to earn the upside, one has to wade through the downside. That is just the reality of the market. Stocks are generally more volatile than fixed income, and returns can vary greatly from year to year. As a result, stock investors may be tempted to abandon a long-term strategy when the markets are down.

There are strategies that claim to identify the peaks and troughs. However, no academic study can verify the veracity of such market timing claims. They are neither repeatable nor add value. The most effective investment strategy with the accompanying academic stamp of approval is good old-fashioned asset allocation. Asset allocation may not be as exciting as buy this, sell that, jump on one trend, and dump the other. Yet, designing a portfolio of different assets and asset classes with different risk/return characteristics has been proven to be the best option to achieve financial objectives.

The odds have favored investors who take a long-term approach. Historically, sticking to a long-term investment strategy has paid off, with average stock market returns being mostly positive over time.

Asset allocation does not guarantee that the downside will be avoided, nor does it guarantee that objectives will be achieved. What it does is provide a probabilistic goal achievement with better risk controls. While past performance does not guarantee future results, history has shown it has been beneficial for investors to stick to a plan and stay invested for the long term.

Recent Comments