Social Security – It’s the choice of a lifetime.

Your choice on when to file could increase your annual benefit by as much as 76%*

Don’t Let Your Benefits Go To Waste

We will never sell your information. We don’t spam. Always private and confidential.

Here’s what you can expect to learn

Strategies Designed To Maximize Your Benefit

How Social Security Is Calculated

Spousal & Survivor Benefits

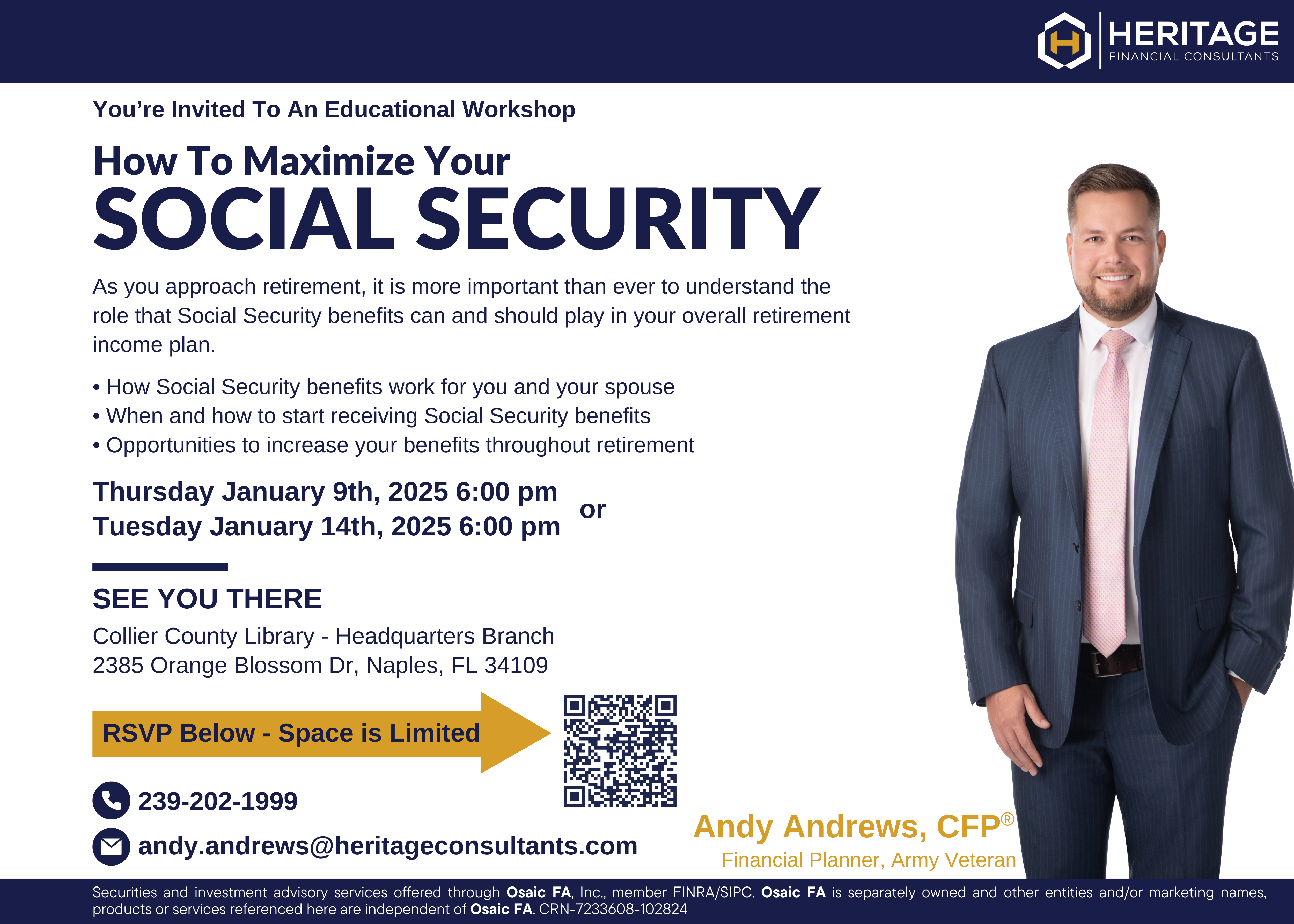

Andy Andrews, CFP®

Financial Planner, Fiduciary**, Army Veteran

I come from humble beginnings – a blue-collar family where every dollar mattered and the future wasn’t always certain. Growing up in that world taught me grit and heart. Later, when I joined the Army, I carried those values with me across the globe, and it was during a deployment in Afghanistan that I stumbled into what would become my true calling: helping people make the most of what they’ve worked so hard to build.

Now, back home in Florida with my wife, Catie, and our two boys, Aiden and Luke, I get to live out that mission every day. I know firsthand the worries that come with planning for the future, especially in a world that can feel like it’s always shifting. My goal is simple – to make the financial side of life a little clearer and a lot more manageable for folks who’ve spent their lives working hard, just like my family always has.

You Only Retire Once – Let’s Start Planning

*The percentage increase in Social Security benefits depends on your full retirement age (FRA). For individuals with an FRA of 66, claiming benefits at age 62 results in a 25% reduction, receiving 75% of the primary insurance amount (PIA). Delaying benefits until age 70 provides a 32% increase over the PIA. This means the benefit at age 70 is approximately 76% higher than at age 62. For those with an FRA of 67, claiming at 62 results in a 30% reduction, receiving 70% of the PIA, and delaying until 70 provides a 24% increase, making the benefit about 77% higher than at age 62. https://www.wsj.com/buyside/personal-finance/financial-tips/when-can-i-collect-social-security

**To the extent that I am providing you with investment advisory services, including either financial planning services or ongoing investment advice as part of an Osaic FA investment advisory program (i.e., fee-based managed account) pursuant to a written agreement and related disclosures that describes this investment advisory relationship, I am acting in a fiduciary capacity related to those services under the federal securities laws, in particular the Investment Advisers Act of 1940.

Unless otherwise identified, Associates on this website are registered representatives of Osaic FA, Inc. Securities and investment advisory services offered through Osaic FA, Inc., member FINRA/SIPC. Osaic FA is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic FA.

*Associated persons of Osaic FA who hold a JD and/or CPA license do not offer tax or legal advice on behalf of the firm.

Osaic FA, Inc. and its representatives do not offer tax or legal advice. Individuals should consult their tax or legal professionals regarding their specific circumstances.

Not all registered representatives with our firm are able to offer advisory services.

See Osaic FA’s Form CRS Customer Relationship Summary, available here, for succinct information about the relationships and services Osaic FA offers to retail investors, related fees and costs, specified conflicts of interest, standards of conduct, and disciplinary history, among other things. Osaic FA’s Forms ADV, Part 2A, which describe Osaic FA’s investment advisory services, Regulation Best Interest Disclosure Document, which describes Osaic FA’s broker-dealer services, and other client disclosure documents can be found here.

CRN-7353625-111824

© 2024 Heritage Financial Consultants, LLC