If you blinked, you missed it. Bond yields are starting to normalize. Longer maturity bonds naturally have higher yields than shorter maturities. The reason is simple: bond yields compensate bond investors for risks taken. Longer maturity bonds present more risk as lenders’ assets are tied up for longer.

For over two years, this natural bond dynamic was inverted. To clarify, shorter-term bonds had higher yields than longer-term

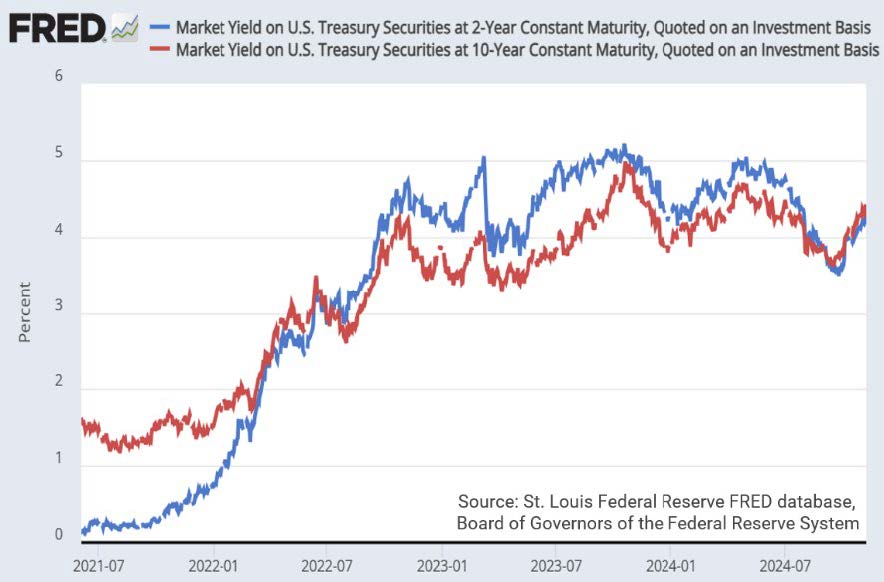

bonds. Notice the 2-Year Treasury yield (blue line) was above the 10-year Treasury yield (red line) between summer 2022 through the third quarter 2024.Bond inversions are rare, but they do happen. Deductive reasoning reveals the cause: risks in the near-term are greater than risks in the long term.

The latest bond inversion is an oddity from a couple of different viewpoints. First, the duration lasted 26 months1, more than twice the typical duration. Secondarily, bond inversions tend to precede recessions. Yet, no recession has been recognized, and it appears the economy is getting a second wind.

Over the past couple months, bond yields are normalizing. Does that mean we have surpassed the recession threat? Not exactly. When analyzing historical bond yields, normalization tends to occur just prior to a recession. So, based on yield analysis, we’re not out of the recession possibilities just yet.

On the positive side, inflation is in a comfortable zone with further downward pressure… at least in the near term. Economic growth has moderated from last year’s peak but continues to chug along at a handsome clip. Corporate earnings are also in a very comfy range. Consumers and corporations should benefit from the Federal Reserve’s lower interest rate commitment, future data permitting.

We are wary about the recent post-election market slingshot. Already elevated equity valuations have risen to frothy levels. Though, frothy valuations are mostly relegated to large-cap stocks. Reinforcing frothy valuations are low dividend yields. U.S. stock dividend yields are rivaling all-time lows. It can be said that stock investors have become somewhat complacent.

The current economic backdrop can be considered close to a Goldilocks economy. Bonds are well poised for the Federal Reserve’s suggested path. Stocks are frothy and priced to perfection, making them sensitive to negative news and revisions and subject to a possible near-term pullback. Should a pullback occur, it would behoove you not to get emotionally involved with a directional change, which is, of course, easier said than done.

CRN-7289681-111224

Recent Comments