“Sell in May and go away” is an old Wall Street adage suggesting summer months offer lackluster returns. The inference is investors are better off liquidating equity positions and enjoying their summers worry free. Many songs have been written by the Beach Boys, Marvin Gaye, the Go-Gos and others about the picturesque carefree summertime.

The origin of the saying is unknown, but it is believed to have originated in London as merchants and bankers would vacation in the countryside. American investors adopted the phrase which accompanies the quintessential American summer vacation filled with road trips, camping or lazy beach days.

The reasoning for “Sell in May and go away” seems pretty sound… idle days lead to subdued product/service demand, lessening company earnings. Afterall, laying out on the beach or going for a bike ride do not require large purchases. Seems reasonable, however reality is not that simple. Businesses continue to sell products and offer services to paying customers. Consumers merely alter their purchase preferences and priorities. Especially in the current world of subscription services, the argument for a summer lag is less prevalent.

Basic investment theory would also reject such a cliché. Traders are a competitive group. They exploit any market inefficiency to their advantage. Should this simple phrase encapsulate a bona fide market inefficiency, traders would simply place trades to profit from a declining market. Inefficiency gone.

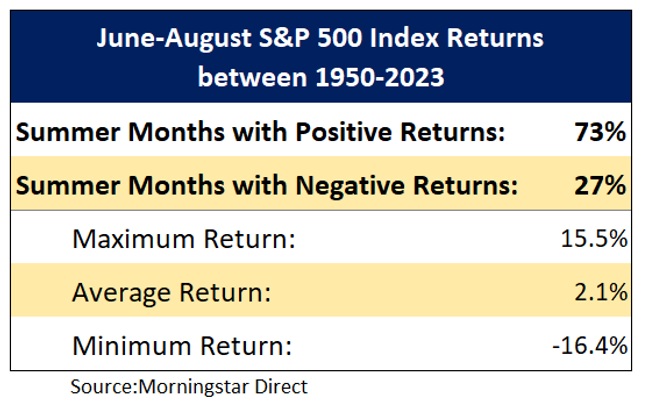

Empirically, we reviewed the performance of the summer months (June – August) for the past 74 years. Interestingly, 73% of the time produced positive returns, while only 27% of the time produced negative returns. Further examination shows the average three-month return was 2%, which annualizes to about 8%. This is not too far off from the long-term annualized return for stocks. Similar to other calendar periods, summer months experience advances and declines. In other words, there is nothing extraordinary about summer.

Other items investors should also consider would be the tax impact of such a strategy. Assuming consistent annual implementation, this would mean all realized gains would be higher short-term capital gains brackets, not lower long-term capital gains brackets. Lastly, investors would have to determine a correct reentry point, which is a near impossibility.

In some ways, investing emulates the complexity of life. Investment discipline cannot be boiled down to a simply phased formula. Diligent observations and analysis of economic and market developments are the best-proven ways to guide investment portfolios. Enjoy your Memorial Day weekend and time with friends and family.

CRN-6640576-052124

Recent Comments