“Don’t fight the Fed” is an old investment adage. It is meant to as a reminder that monetary policy is a major driver of investment direction. Professional money managers and investment strategists analyze every word from every speech, press release or commentary offered by the Federal Reserve (the Fed) for any hint of monetary policy change. Keep in mind, U.S. monetary policy reaches far beyond its borders.

The Fed’s dual mandates are to stabilize prices (i.e. control inflation) and maximize employment (i.e. foster an environment for jobs). Sounds simple, but very complicated to execute as the Fed only effects interest rate policy and money supply.

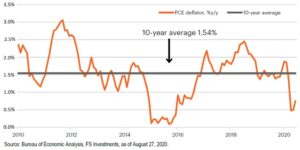

The Federal Reserve released its first policy strategy change (evolution) since January 2012 on August 27¹. The Fed has changed its long-term inflation goal to “average” 2% instead of a long-term inflation target of 2% (which has rarely been achieved during the past 10 years). The Fed changed its posture due to the current drastic employment situation.

Promoting an environment for job growth means keeping interest rates as low as possible. Low rates encourage companies to invest in projects, purchase equipment and explore opportunities. All of this encourages job growth, directly or indirectly. So, the Fed intends to keep interest rates low for a long time because job creation trumps all else, even if inflation moves above the 2% target. The risk of low rates for too long is inflation, and if not held in check could create high inflation similar to the 1970s-‘80s.

The Fed has learned long ago not to surprise the markets with unexpected announcements. Although inflation is not likely any time soon due to the extremely lack labor markets, the Fed is projecting their intention well in advance. Equity and fixed income markets anticipated the Fed’s policy evolution, which is why the markets shrugged off August 27’s declaration.

What does this mean for the economy and investors going forward?

Interest rate sensitive and capital-intensive sectors (such as housing, automobiles, construction, manufacturing, etc.) will likely get a helping hand. Lenders of capital (fixed income investors) should prepare for income erosion as bond yields reflect the low rate environment. Yet even with the suppressed yields, fixed income securities should still be considered the primary shock absorber to equity volatility.

CRN-3227323-090220

Recent Comments