How is investment success measured? A simple question deserves a simple answer. But the answer is more elusive than it seems. The media complicates things by publishing returns of a few indices (such as the S&P 500, Dow Jones Industrial Average or the NASDAQ) and ignores multiples more. Focusing on just a few offers jaded expectations.

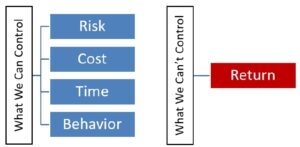

Performance is often incorrectly equated to return. Return is only one side of the coin. The other side is the often ignored “risk.” Risk goes unreported mostly because it is not easily quantified. Risk comes in many different flavors, some observed and some lurking below the surface primed to strike if the conditions are right. It is often stated that portfolio management is more about managing risk than achieving return.

In a perfect world we would measure not only performance, but items like risk and allocation. In addition to an investor’s risk tolerance, goals and other constraints are important items to track. Well-designed wealth-based portfolios should address multiple facets of investors’ lives. Many of these are not financially oriented, but life oriented; such as inheritance plans, education, charitable intent, near-term versus long-term goals, retirement desires, etc.

Addressing these can be accomplished formally or informally. This can include maintaining a formal Investment Policy Statement (IPS) or informally via portfolio guidelines through financial planning or other set of metrics. The ongoing review of an IPS, financial plan or general notations can ease anxiety, as well as dynamically modifying objectives as needs change over time.

Most importantly, a portfolio is not built to replicate an index. Indices were developed to represent an aspect of the financial markets. This could be large cap growth stocks or investment grade bonds or even industry specific sectors. Simply following the returns of an index ignores many factors pertinent to investors. Portfolios are designed to accomplished targeted personalized objectives while addressing risk tolerance, specific goals (such as education or retirement), supporting cash flow needs, estate planning or complement insurance solutions. Simply following index returns ignores risk and individual preferences.

An index can be described as a mythical creature that can lead an investor to focus on the unrealistic and impractical, not what matters to them the most. Ensuring that a portfolio stays on track is helpful, but history has shown horrid consequences for treating investing like a competition. With that said, it is often best to focus on what you can control and what matters, which is a well-diversified portfolio managing risk.

CRN-3429713-012921

Recent Comments