Recent inflation data has brought back the debate about enduring or fading inflation. Time will settle the debate with the Federal Reserve playing a central role. In an attempt to maintain viewership, financial media highlight data anomalies and quickly offer answers to unasked questions.

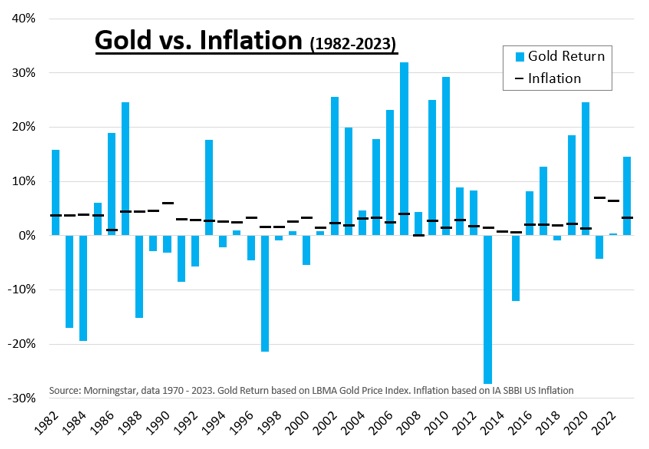

Gold is often touted as an effective tool for protecting wealth from inflation. An effective inflation-hedging tool should have return variations that are similar to price changes. But history is clear, gold and inflation have no meaningful statistical relationship.

The tale of gold as an inflation hedge goes back over 50 years. A post-WW II decree pegged all currencies to the U.S. dollar and the U.S. dollar was pegged to gold at a rate of $35/ounce1. International banks could deposit/redeem gold from the U.S. via the exchange into the U.S. currency. This was referred to as the “gold standard” (and also helped introduce the U.S. dollar as the world’s reserve currency).

1971 marked a groundbreaking pivotal change. At the urging of Federal Reserve Chairman Arthur Burns, President Nixon announced decoupling the U.S. dollar from gold1, eliminating the “gold standard.” Burns grew increasingly worried that rising inflation and increasing international export competition would cause a run on the gold reserves held in the United States. Decoupling the U.S. dollar from gold was designed to mitigate a run on the gold reserves and alleviate the international monetary system from a potential collapse.

Abandoning the gold standard advanced international finance, yet inflation continued its upward trend for another ten years. Gold prices also rose over the next ten years due to various economic and non-economic factors. Therein lies the recognition that endures to this day. Even though intra-period changes demonstrated a weak correlation between the two, the tale had been sown as gold and inflation ended higher.

The initial 10-year period following the dollar-gold decoupling was questionable at best. Yet, a complete review of inflation and gold prices over the past 40 years has clearly exhibited there is no relationship between the two. This can be seen pictorially by the included chart and scientifically via statistical methods. Oddly, financial commentators continue to perpetuate this gold-inflation myth. Maybe it just gives the media something to talk about, so they can sell advertisements to an audience? It is reasonable to be concerned about rising prices, but investors who want to hedge against inflation may find gold to be the wrong tool for the job. Please enjoy your weekend, hopefully learning a new bit of economic history debunking an erroneous myth.

CRN-6625327-051524

Recent Comments