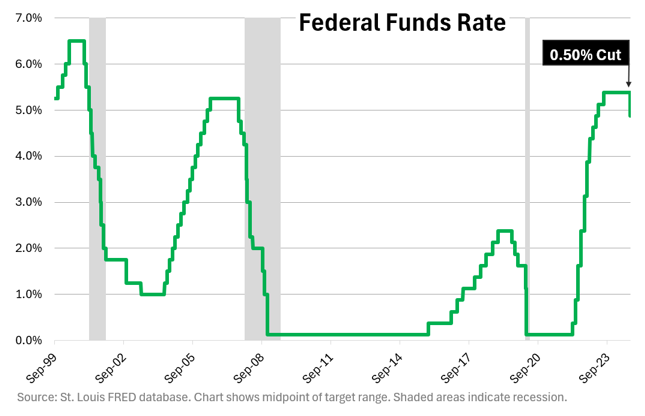

The Federal Reserve (Fed) has finally embarked on the much-anticipated next rate cycle phase. During the Fed’s September meeting, the Fed decided to commence cutting interest rates. The Fed started the next phase with a parade and fireworks, cutting rates by 0.50%. Financial markets applauded such aggressive action as various stock market indices rallied to new highs. As with most things, the devil is in the details. So, let’s decode Fed Chairman Powell’s remarks.

The most notable change is the use of the word “recalibrate.” Recalibrate, or a version of the word was used 10 times in Powell’s press conference1. The Fed wants to normalize interest rates given the subdued inflation releases over the past few months. Having brought inflation back to acceptable levels with the confidence inflation is under control, the Fed sees no need to maintain such high levels.

“Recalibrate” also refocuses the Fed back to its dual mandate. Given the continual inflation talk over the past few years, we often forget the Fed has two mandates: 1) stable prices (i.e., manageable inflation) and 2) full employment. The Fed has been so focused on fighting inflation that the employment mandate has mostly been ignored, rightfully so, as the low unemployment rate took care of itself. Refocusing on both objectives is apropos, as labor markets have recently shown softness. The most telling is Powell’s comment that “the upside risks of inflation have diminished, and the downside risks of employment have increased.1”

Powell was careful to recognize the overall strength of the economy in the second sentence of his announcement. With recent weakening economic data and downwardly revised employment numbers, such a pronouncement early in the press conference makes one thing of Gertrude in Shakespeare’s Hamlet, “doth protest too much.” Only time will tell.

The Fed disclosed their expectations over the next couple years. By the end of 2025, the Fed expects to cut rates an additional 1.50%. However, the financial markets are expecting a more aggressive 2.00% in cuts over the same period. Both can’t be right. Powell is famous for stating, “We follow the data,” giving room for adjustments. Only time will tell if either is correct or both are wrong, but the direction is what’s important. Financial professionals and the Fed are clearly indicating the interest rate descent has begun.

This is a good time to remind investors and borrowers of floating rate investments and loans should see lower interest rates. Investors of the safest instruments such as money markets, CDs, and Treasury Bills (often referred to as cash equivalents) will begin to see interest earnings decline. At the same time, floating rate loans such as credit cards, HELOCs, or floating rate mortgages should require lower interest payments.

Powell could have been more direct about the 0.50% cut instead of enacting the often-mentioned 0.25%. His response could have been, “With core inflation now under control, interest rates of 5.25% – 5.50% are too restrictive and could hinder continued economic expansion.” A simple sentence with a simple message.

1https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20240731.pdf

CRN-7057413-092424

Recent Comments