Bonds, a.k.a. fixed income, are causing money managers and portfolio architects at bit of heartburn. Historically, fixed income has provided three advantages to investors; income, equity diversification and stability. Yet, the current state of yields has caused a conundrum of fixed income.

The primary return component is the yield or income the bond generates. Bonds have a stated yield or interest rate. As such, bonds tend to generate a reliable source of income for investors. Bond managers factor in yield as accretive to total returns and positive cash flow to the investor. Portfolio architects look to bonds (and their yields) to help cushion equity market volatility and provide overall portfolio risk mitigation.

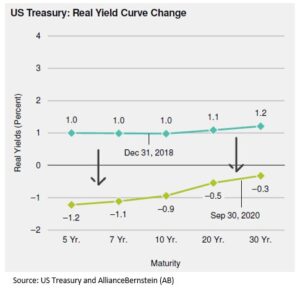

Enter 2020 and the reaction to COVID. The Federal Reserve’s efforts to generate economic activity is to maintain a low interest rate policy. In fact, yields are so low that US Treasury bond yields (investment theory deems Treasuries “risk-free”) are lower than expected inflation. In other words, US Treasury bond investors will lose buying power. (Yields adjusted for inflation are referred to as REAL Yields.)

Unfortunately for investors, this also has a negative effect on portfolios. First, lower rates mean lower income generation for savers and investors. Secondarily, lower rates reduce the effectiveness to absorb equity market volatility and help reduce overall portfolio volatility.

Here is the conundrum… bonds have been a vital contributor to portfolio for both income generation and equity risk mitigation. Yet, going forward, bonds will not likely to be the contributor they once were.

Is it still worth including bond investments? Absolutely! Bonds still offer limited income (although a scant amount), are the primary equity volatility shock absorber (this week is proof volatility hasn’t dissipated) and contribute to overall stability. Investors simply need to adjust expectations.

Investors may need to look elsewhere for income. Income can be generated via stock dividends, real estate leases/rents or annuity payouts. All introduce different forms of risk. Alternatively, bond investors could accept the higher yields of lower credit quality bonds, which come at the expense of equity sensitivity. Lastly, investors could earn capital gains of more aggressive bond trading techniques. Yet, capital gains “income” is less reliable and less consistent than stated yields. More likely, a combination will be the course of action. At the end of the day, bond investors will need to accept higher or different risk for the similar benefits of yesteryear bonds.

CRN-3307726-102920

Recent Comments