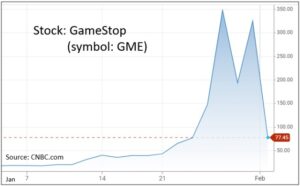

Fad investing has taken a new twist. Merriam-Webster defines a fad as “a practice or interest for a time with exaggerated zeal.” What better way to describe recent headlines of just a handful of stocks? Stock prices of GameStop, AMC and a few others experienced some incredible gains in just a few days. As of this typing, the stock prices are returning to their pre-fad levels.

What happened? How can stock prices increase over 1600% in days? In short, some market participants use very aggressive trading strategies to take advantage of perceived opportunities. For every bet, there is a counter-bet. Periodically, these participants battle each other which results in odd market behavior. The targeted investment is incidental to true investment fundamentals.

Financial markets serve many purposes. The first is to match those in need of capital with those who have capital. Secondarily, the financial markets serve as a place to determine current security pricing for stocks, bonds and other instruments. In theory, financial markets are a democratization of ALL market participants’ views. The capricious price fluctuations are the “debate” between the thousands of participants making their voices heard. Think parliament with everyone talking and debating out loud at once. It seems chaotic to observers and outsiders, but there is a method to the madness.

Unfortunately, a third element of speculative trading enters the foray. There is a deliberation about the validity of such trading. One argument suggests speculative trading helps financial markets ring out inefficiencies. The counter argument suggests speculative trading can cause distortions, such as GameStop. Both are correct.

In the recent case, initial bets by hedge funds were positioned to profit from expected falling stock prices of a few targeted stocks. This is known as “short selling.” Another set of speculators bet the opposite. In the very near-term, some hedge funds realized very large losses as they lost the bet. Yet, as the price falls back to a normalized range, the counter speculators, specifically those that bought new highs, will realize losses.

Over time, regulators have reacted to unscrupulous activity. Financial markets are some of the most regulated industries in the U.S.. Regulators are keen to ferret out trading for illegitimate means or price manipulation, while letting the democratized price debate persist, it’s a fine line. There is no doubt that regulators will review the trading activity, social media posts and other data to determine if laws were broken or if new regulations should be enacted.

It could be tempting to jump aboard the latest investment fad, although mostly unwarranted. A disciplined review of fundamentals, news and a dose of common sense can help stay away from the sharp barbs that can inflict portfolio injury. We appreciate the continued trust you have placed in us.

CRN-3438777-020421

Recent Comments