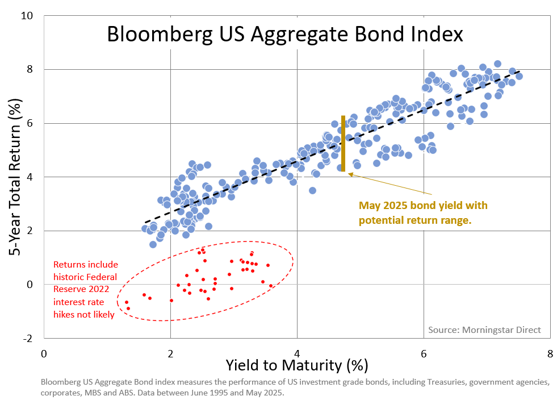

5.25%. Curious about what bond returns will be over the next 5 years? Our calculations suggest with a high degree of certainty that annualized bond returns will range between 6.2% and 4.3% with a bullseye of 5.25%.

For the last few years, fixed income markets have garnered more attention than in the past few decades. Seems odd for a boring asset class mostly regarded as an income generator with a low risk profile. The attention is likely due to the abnormal performance created by the unprecedented 2022 Federal Reserve rate hikes which produced historical bond declines. 2022 was akin to a biblical flood. Due to the extremely unique set of circumstances, we will take this period with a grain of salt.

Investors are often biasedly backward looking. Investors tend to succumb to recency bias, the psychological tendency to overweight recent happenings over the full historic dataset. All of us need to remain on guard for our own prejudice clouding our judgment.

When we analyze longer time horizons, attempting to circumvent our recency bias, we find that starting bond yields have a high predictive power over subsequent returns. A bond’s Yield-to-Maturity (YTM) is the income the bond is expected to generate if held to maturity. A bond’s yield is also the bond’s primary return component. So, it should not come as a surprise that yields portend subsequent total returns. Reviewing a basket of bonds, i.e., an index, offers insight into the bond market as an asset class.

At the end of May 2025, the main bond index, the Bloomberg US Aggregate Bond index, was yielding about 4.71%1. Once we account for possible bond market changes, weighing possible scenarios, and reviewing historical statistical patterns, we can develop the above forward-looking total return outlook. Yes, this is geeky bond math that most find very boring… understandably.

How does this affect you? Bonds are used within a portfolio as either an income generator and/or a risk mitigation device. If you are looking for income, do annualized returns of 5.25% tickle your fancy? I think most would say yes. If used as a risk mitigation device, bonds now exhibit shock absorption not seen since early 2009… 16 years ago.

Bonds may have acquired a lot of attention lately, but likely for the wrong biblical flood reasons. Admittedly, 2022 hurt 3- and 5-year forepassed returns. That’s water under the bridge. Attention should be focused on the future. Going forward, we have not seen bond opportunities like this in a long time.

Recent Comments