Surprise! The first quarter’s economic performance gauge released last week fell short of expectations. The expectations were for menial growth of 0.2%1, but the preliminary calculation came in at -0.3%. This is not what we want to see. It’s easy to blame it on the on-again, off-again tariff talk, but that didn’t happen until April. So, a deeper dive is required to grasp a better understanding of the first quarter’s economic preliminary results.

You may have noticed the word “preliminary” a couple of times in the opening paragraph. That is because Gross Domestic Product (GDP), the economy’s speedometer, is released in threes: preliminary/advanced, revised, and final. So, last week’s number is subject to revisions.

A deeper dive is necessary to figure out if the downward surprise is the beginning of a trend or if the first quarter was subject to unrepeatable anomalies. Upon review of the preliminary data, the latter seems to be the case. Let’s take a look at the two anomalies.

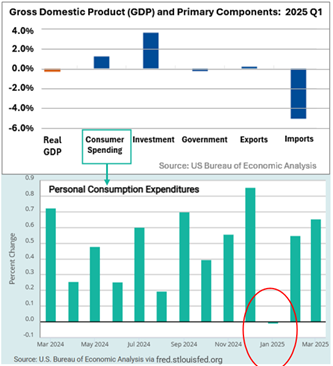

The first aberration is consumer spending. The quarterly consumer spending component registered a positive, yet low, number. The monthly data reveals a slight contraction of consumer spending in January 2025. A weak January is fairly normal following a strong holiday spending season, which is what we experienced during the 2024 holidays. That explains some of January’s pullback, but not all of the weakness. Recall, there were two happenings which likely reduced January’s spending. The first was a particularly harsh winter, keeping people indoors and curbing spending intentions. The second was the three-week-long California fires that whipped out vast areas of wealthy neighborhoods, preoccupying wealthy spenders and keeping the rest of us glued to our televisions.

The second irregularity is the imports component. Tariff talk escalated between the inauguration and April 3rd’s “Liberation Day.” Tariff talk prompted abnormally high import demand, especially in March. Companies accumulated inventories (increasing imports) to hedge against potential tariff announcements. Though this was not a direct tariff impact, it is fair to say it was an indirect tariff effect. Imports are a detraction from GDP, so the abnormally large import number pushed GDP into negative territory.

The combination of these two anomalies generated a negative preliminary economic grade. These two one-time events had a compound effect, generating a negative preliminary first quarter report card. We will monitor the revised and final iterations of the first quarter GDP as well as data to support GDP in the current quarter.

Recent Comments