You may recall the 1985 hit movie Back to the Future starring Michael J. Fox. Fox played Marty McFly who mistakenly traveled to 1955 in a stylish DeLorean time machine, struggling to return to 1985. Interestingly, 2020 was similar to the movie. The year began on a good note with positive economic and market tailwinds. Before we knew it, turmoil ensued turning the world upside down. Yet, by the end of 2020 everything seemed on the path to normalcy… dare I say, maybe better positioned for the future. Similar to Marty’s return to 1985, Marty’s 1955 antics seemed to better position his future.

The fourth quarter saw the end of uncertainty induced volatility, which is always the market’s kryptonite. The two main areas of uncertainty were the U.S. elections (concluding on November 3rd) and COVID vaccine progression (introduction and approval of multiple COVID vaccines occurring in November-December). This gave investors enough confidence to stop worrying about the current circumstances and focus on the future.

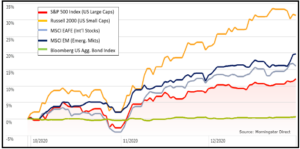

The sudden post-election lurch higher was a welcomed phenomenon, but more surprising was the broad market participation. Many asset classes that were left out of the summer rebound took center stage as smaller companies and international stocks beat their larger U.S. brethren. This held true for industry sectors as more value-oriented sectors snapped back to attention and readied for the anticipated cyclical upswing. The importance of a diversified asset allocation could not have been more warranted and so key going forward.

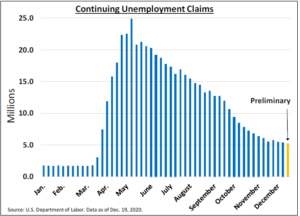

As we look ahead, all eyes are on the employment situation. Getting people back to work is priority number one. Continuing Unemployment Claims is a great proxy for the labor market structure. Even with the peak in May 2020, great strides have been made with expectations beaten almost weekly. The last data point included the recent COVID shutdowns but has not captured the post vaccine distribution effects. It is important to note that the goal is not to get to zero Continuing Unemployment Claims, but to get back to the nature floor around 1.7 million claims. Meaning, we are only about 3.5 million away from the goal.

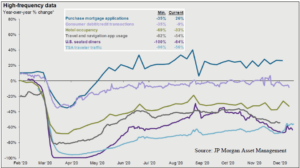

High frequency data are showing general improvement. High frequency data are daily or weekly data that offers a glimpse into typical lifestyle activities; such as credit card transactions, dining out or traveling. Some territory still needs to be recaptured; however improvement is clearly in the cards.

Restaurants are of particular note. They were most sensitive to the holiday restrictions. This period was doubly difficult as restaurants were on the most recent shutdown short list during a normally booming period. The visible decline of the U.S. seated diners is a good representation of their front-line positioning. This is believed to be a near-term issue from the recent COVID wave. Public inoculation as well as the virus’ natural ebb and flow can be expected to break the recent downtrend.

Governments around the world are doing everything they can to provide much need aid and economic stimulus. World central banks are committed to holding interest rates at extreme lows while also making sure there is plenty of money available in the system. This is not the policy of only the U.S. Federal Reserve, but all major central banks; such as the European Central Bank, Bank of Japan, Bank of England, etc. Additionally, all central banks have communicated their commitment to maintaining an extremely simulative posture for as long as necessary… interpreted by many as at least two more years. Not to mention, the incredible fiscal infusions to help people pay their bills and keep businesses afloat.

Bond investors should be prepared for “bond-limbo.” Bonds and other fixed income investments are not likely to be the income earners they once were as the bar has been reset. Even the low rates of the past decade look appealing to what is likely to be available in the years ahead. Bonds will remain an important part to counteract stock market volatility, but income investors should be prepared to evaluate different forms of income producing assets for the coming few years.

With the US presidential inauguration around the corner and dissemination of COVID vaccines, much uncertainty is being wrung out of the market. However, life is a risky endeavor and risk will always be present. Geopolitical risks (especially China and Russia) seem to be taking the forefront. This can include covert exploits via hacking and other cyber espionage. The good news is that the global economy and investment markets (in aggregate) seemed to be well positioned for the future, as long as the progress against COVID isn’t sidetracked. A well-diversified portfolio is even more critical in today’s environment.

We recognize 2020 has been a tumultuous year. Thank you for the confidence you’ve placed in us. Please don’t hesitate to call or email should you have any questions. Lastly, should you encounter Marty McFly… please warn Marty to avoid 2020! Hope you had a wonderful Holidays and wishing you a safe and Happy New Year.

Recent Comments