Pay attention to the credit markets; they are telling us something. Credit markets are the worrywarts of the financial world. Always concerned the sky is falling. In some cases, yield changes may be signaling something is afoot, while other times might simply be jittery investors.

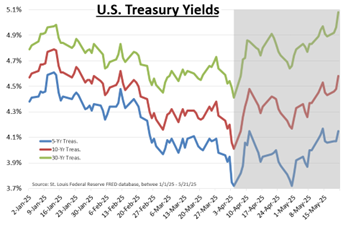

Trump’s tariff announcement in early April sent a shock through the financial markets. Yields,

which rise when bond prices fall, have climbed for weeks due to several factors—some welcome, others not.

Fading recession fears. Steps by the Trump administration to walk back some tariff policies have increased optimism that the U.S. can avoid a recession. That has sapped demand for Treasuries, which tend to benefit when investors are anxious about the economic outlook and expect the Federal Reserve to cut short-term interest rates.

Inflation anxiety. Coming off the highest inflation rate for 40 years, investors are still sensitive to inflation upticks. Recent media discussion of how tariffs could affect prices exacerbates the inflation sensitivity. The media have focused on the near-term inflation bump, while others have extended tariff impacts to the long term. Logical thought does suggest tariffs could have an impact; however, it would be wise to temper inflation conclusions as we are in the early innings of the tariff negotiations.

Growing fiscal concerns. Investors had expected Republicans to extend expiring tax cuts, but progress on that front has put fiscal concerns back in the headlines. Larger deficits push up Treasury issuance, and investors worry that demand won’t keep pace with supply. As a result, bond investors are demanding higher yields.

Rising yields overseas. Yields have also risen in other key markets, like Germany and Japan, partly because investors expect more bond supply in those countries as well. When yields rise overseas, U.S. yields often also climb to reflect the fact that investors now have more ways to earn a decent return on safe government debt.

Concerns about foreign demand. This anxiety has eased since the immediate aftermath of Trump’s April 2 tariff announcement, but concerns linger. Investors in the U.S. worry that market participants elsewhere could buy fewer Treasurys for a variety of reasons, including a broad sense that U.S. institutions aren’t as sound as they used to be.

We should caution investors not to internalize bond market movements as concrete conclusions. As mentioned above, credit markets are the worrywarts of the financial world and ponder worst case scenarios. It is important to observe the different market perspectives, including the worrywarts, but be careful not to take them as gospel.

Recent Comments