Could the Federal Reserve (Fed) do it? Could the Fed pull off a soft landing? To level set, a “soft landing” occurs when the Fed raises interest rates to purposefully cool an overheating economy or battle inflation without causing a recession.

A soft landing is extremely difficult to execute. It requires extreme patience, an unwavering temperament, rate-raise shrewdness, and superb timing. All this while private sector prognosticators, business chieftains, and the media brashly offer their criticisms.

The Fed has been able to deliver a soft landing about 20% of the time. Of the past 10 rate hike cycles, the Fed engineered a soft landing in only two1. The statistics do not favor a soft-landing scenario, giving critics fodder for their remarks.

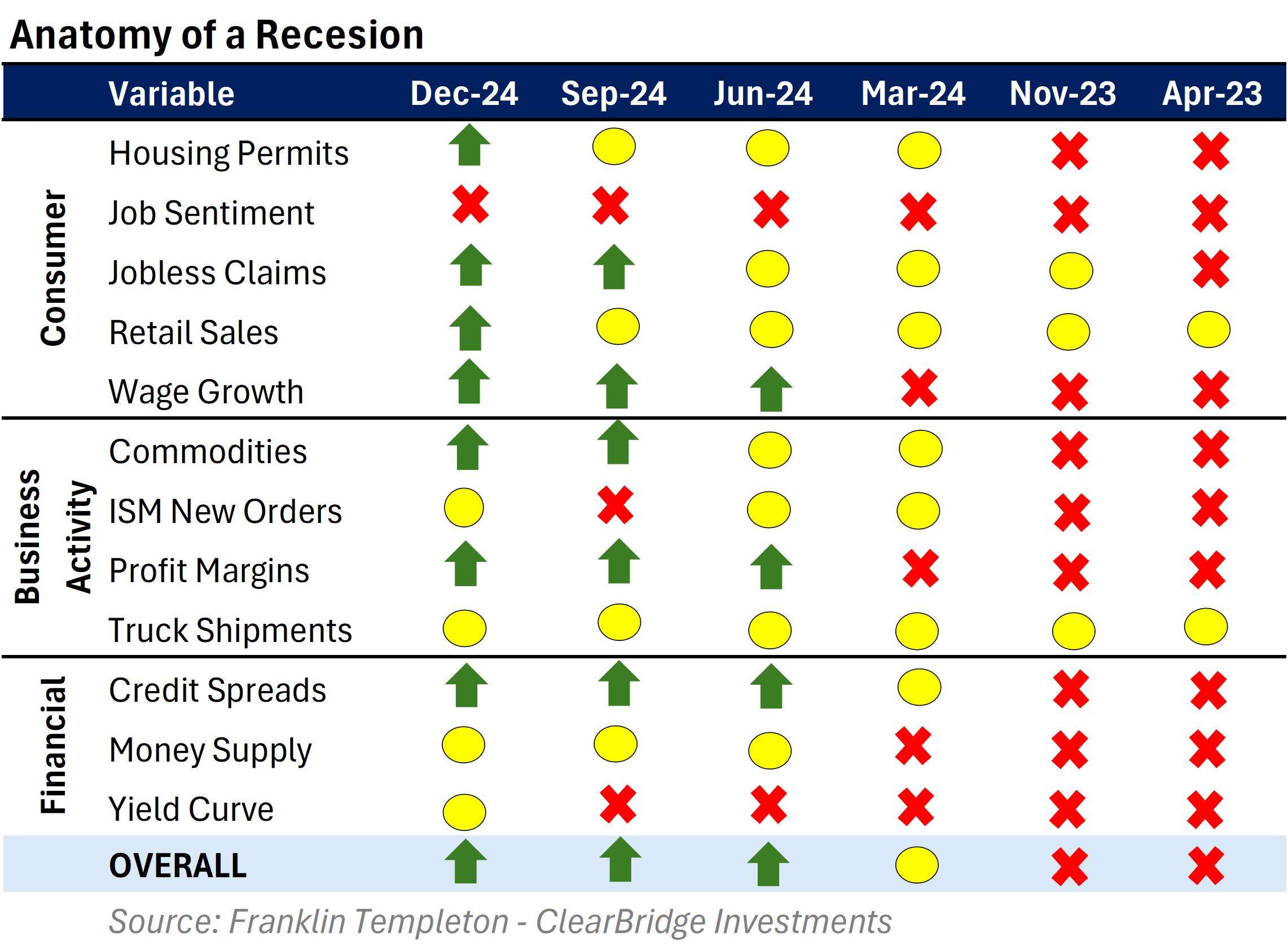

Through much of 2023 and into 2024, classic recessionary indicators were flashing red. It was no surprise that about every economist, strategist, and financial professional was calling for a recession. Much to everyone’s surprise, throughout 2024, recessionary pressures eased and gave way to an expansionary wind. The accompanying table chronicles the development of the more notable economic activity indicators. It has been remarkable to see almost all indicators turn from red to green.

Where do we go from here? Monitoring these traditional measures gives the indication that the economy is doing very well with little to worry about. Generally, that would be correct. Falling interest rates have reduced borrowing and financing costs, increased profit margins, and reduced commodity prices. Likewise, consumers (about 2/3rds of the economy) seem to also be pulling their weight. Yet, a review of more granular data may give you pause.

There are cracks in the consumer picture that we are monitoring. Overall, credit card debt is near all-time highs. Credit card delinquencies are relatively high, though they are easing. Spending on hotels and dining away from home has eased, suggesting consumers may be pinched. Holiday shopping surveys indicate reluctant gift purchases. When reviewing the spending data, high-income individuals have plenty of discretionary dollars, but middle- and lower-income persons are struggling. In short, the high-level aggregate consumer data may not be as bright as it appears.

The final inning has not been played. The game-winning soft landing is not just in the cards but the likely outcome. Kudos to the Fed. But the story does not stop there. Unlike a sports game, the economic game never ends, it simply evolves. It is important to stay vigilant in monitoring areas that can trip up the status quo. We will continue to do that. We appreciate the trust you have placed in us.

CRN-7551764-012125

Recent Comments