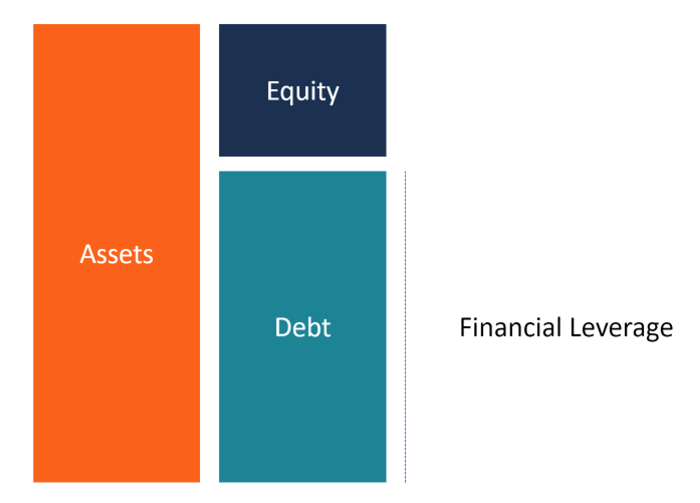

As the new year begins, many people are beginning their New Year’s resolutions and setting the bar high by going to the gym seven days a week, cooking clean meals every night and eating no sweets or fattening foods ever again. Unrealistic goals such as these typically get dropped after a few weeks. Instead, what we should be focusing on are the more realistic goals, such as maximizing your financial potential and striving towards your long-term goals. A great way to do this is by understanding your ability to leverage capital. Leveraging capital is a powerful financial strategy that allows you to use borrowed funds in order to achieve your goals. This month, we will discuss some common options available for households when they need to fund projects or meet emergency needs.

First, we will discuss the ability to utilize your home equity. Every homeowner recognizes that a mortgage is a loan from a lender utilized to purchase real estate. Few people have the liquidity to pay the full price, so the government and banking system have designed a system to encourage homeownership with only a downpayment and a low-interest, tax-deductible loan for the remainder. The total cost is spread out over time by making regular payments and paying interest. Generally speaking, each payment you make increases your equity ownership.

Next, we will talk about another property loan that is available when enough equity has been established by the owner. A Home Equity Line of Credit (HELOC) or Loan (HEL) allows responsible owners to use their equity as collateral for another reasonably low-interest loan. A HELOC acts as a revolving line of credit where you can borrow money sporadically using the equity in your home, whereas a HEL is a one-time loan that may be more ideal for a single large event. Both are ideal for home renovations, which may allow tax-deductible interest, college or even some other higher-interest debts that you would like to payoff. Typically, like a mortgage, these interest rates are lower than other personal loans or avenues of borrowing money. If you have built equity in your home, you should consider going through the process of establishing a HELOC to have it available in an emergency—if you wait until the funds are needed, the process can take weeks to complete.

Lastly, we wanted to discuss the broad category of a loan that many people have and already know about, which is a personal loan. These are typically used to finance larger expenses or can be ideal for consolidating debt. Consolidating debt is a great way to get debt under control by combining multiple accounts into one single payment, lowering interest rates, and potentially improving cashflow and credit scores. Without the collateral typically associated with real estate, you can expect higher interest rates with this solution. Your last resort would be credit cards, which should be carefully controlled due to high interest rates and penalties. Too many Americans use credit cards as the first resort and find it is ultimately detrimental to financial security.

Leveraging your capital and strategic borrowing could unlock significant financial opportunities, as long as it is done responsibly. By having your financial goals, risks and finances under control, aligning a borrowing strategy can create paths to your long-term goals and even expedite the process. If you have any questions or would like more information on this, please do not hesitate to reach out to me and we can get a jumpstart on the new year together!

This information is provided for educational purposes only and is not intended to provide direct investment advice. Osaic FA, Inc. and its representatives do not offer tax or legal advice. Individuals should consult their tax or legal professionals regarding their specific circumstances. Diversification may help reduce, but cannot eliminate risk of investment losses. CRN-7494063-010325

Recent Comments