Autumn is a welcomed change from the days of summer. Cooler days, changing foliage, and fall festivities are a favorite of many. Autumn is also an annual reminder of nature’s cyclicality. Financial markets also abide by cyclicality, though not as timely.

In the wake of pandemic shocks, economies appear more “normal” than at any time since 2019. Yet policy rates remain elevated. As central banks cut interest rates to more neutral levels, key questions include how fast

they get there and what those neutral levels will look like. Only time will answer these questions, yet rate-cutting expectations are clearly the dominant force affecting the markets

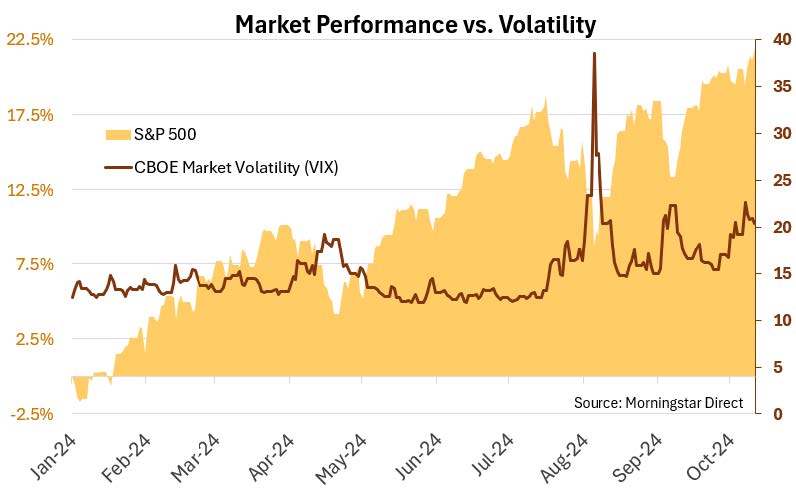

So far this year, investors have bid up to stock prices. This has been driven by inflation’s trajectory, investors’ reaction to the projected cuts, soft-landing prospects, and continued consumer spending despite worries of a hiring slowdown.

Higher volatility has accompanied higher stock prices, indicating an underpinning skittishness. This could be due to the impending election, ratcheted up geopolitical backdrop, stock valuation sensitivity, or a combination. Elevated election volatility is a normal occurrence and should not be a concern for long-term investors. Geopolitical events are worthy of monitoring, though they tend to have short-lived market effects. (More on this in the future.) Valuation sensitivity is the most unpredictable, with the best defense being diversification.

Falling rates and growing confidence bode well for more interest rate-sensitive areas of the market. These include smaller companies, value companies, and REITs. As rates come down, such companies will have better access to capital to explore revenue-generating opportunities and/or reduce their cost of capital. Whatever the cause, these companies finally have a tailwind formally reserved for the Magnificent 7.

With positivity supporting the markets, wise investors should play devil’s advocate asking, “what could go wrong?” Politics aside, the most immediate threat is third quarter earnings announcements. Should earnings fall short of lofty expectations, volatility could ensue, specifically with large cap growth stocks. Additionally, ears will be listening to forward guidance often accompanying quarterly earnings announcements.

It is still a little early to declare “soft-landing achieved, and recession abated.” Yet as this economic cycle progresses, a soft-landing seems increasingly likely. Sticking a soft landing is very difficult. The last soft-land occurred in the mid-1990s… 5 cycles ago, which happened to precede the 1990s tech boom.

The opinions expressed are those of Heritage Financial and not necessarily those of Osaic FA. Forward looking statements may be subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Diversification may help reduce but cannot eliminate risk of investment losses. CRN-7190071-101524

Recent Comments