The bond market is often the most ignored of the financial markets, since talking about interest rates is about as much fun as watching paint dry. Recently, interest rates are getting the lion’s share of attention due to investors critiquing the Federal Reserve’s action, inflation concerns and what seems to be the beginning of a secular rising rate period.

The bond market is often the most ignored of the financial markets, since talking about interest rates is about as much fun as watching paint dry. Recently, interest rates are getting the lion’s share of attention due to investors critiquing the Federal Reserve’s action, inflation concerns and what seems to be the beginning of a secular rising rate period.

Interest rates have been falling for about 40 years, a very long period. Bond yields fell from almost 16% in September 1981 to just 0.5% in August 2020. Interest rates and bond prices are inversely related. So, falling yields provided a major tailwind to positive bond performance over the period.

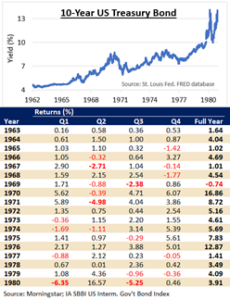

In a mirrored fashion, the period between 1963 and 1980 saw a secular rise in rates creating a rising rate headwind. Given the inverse yield/price relationship, one would assume rising yields equate to overwhelming negative returns, yet the historic reality demonstrated the opposite happened.

A study of the period demonstrates negative returns did happen in select quarters and a single calendar year, 1969. This is hardly the tsunami of negative returns often accompanied with a discussion of rising rates. Ironically, the bond bull market was interspersed with more frequent and larger drawdowns. The 40-year secular rising rate period (1981-2020) had four years of negative years (1994, 1999, 2009, and 2013) which ranged between -1.8% and -5.1% as well as deeper quarterly retrenchments2.

How could this be? How could an environment inhospitable to bonds elicit better downside risk characteristics than an environment in favor of bonds? Partly, the interest rate path is not linear. It is punctuated with ups and downs. Similar to driving from the beach to the mountains, the road is not a straight ramp up. The road is a series of ups and downs to ultimately arrive at the higher elevation. Bond managers can take advantage of these non-linear movements.

Secondarily, the bond market is not a monolith. There are many different components, sub-classes, bond types, credit qualities, maturities, etc. to select from. Switching between these aspects help bond managers mitigate risk and/or take advantage of opportunities.

It would be remiss if the general risk mitigation of bonds was not recognized. History has demonstrated for decades that bonds do not have the risk profile of stocks. Hence, overall portfolio risk mitigation should not be cast aside for fear of rising rates or during volatile times.

We realize transitioning to a new phase or different environment can be nerve racking. It is during these periods when we need to sharpen the pencil and take a lesson from history. History is not simply an encyclopedia of facts, but a teacher willing to share insight. Enjoy the long Easter weekend! Warmest regards,

1St. Louis Federal Reserve FRED database 2Morningstar

Bonds have fixed principal and yield if held to maturity and a default does not occur. Prices of fixed income securities may fluctuate due to inflation, credit, and interest rate changes. Investors may lose money if bonds are sold before maturity or a default occurs.

CRN-4696672-042022

Recent Comments