It’s been said many times… the economy is not the market. The bond market contributes to its direction while the stock market attempts to guess where it’s going. The bond market and interest rates tend to move slowly and methodically as the Federal Reserve attempts to execute its dual mandate of maximum employment with stable prices.

For the most part, stock market investors look for asset (investment) appreciation under an ever-changing foundation. Today’s consumer preferences, technology, products and services are different from 20, 50 and 100 years ago. COVID has accelerated many market dynamics already in play, such as banking apps replacing ATMs. (ATMs being the ubiquitous banking interface for decades, which have been replacing bank tellers and branches since the 1980s.) Although the economy is not the market, investors pay close attention to economic data that may hint at what lies ahead.

Every business cycle evolves on its merits and situational circumstances establishing its own duration. The ’81-’82 business cycle lasted 18 months while the ’08-’20 cycle lasted 146 months (longest on record)¹.

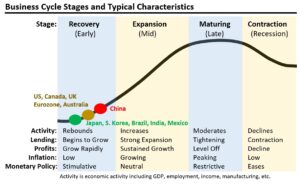

Countries typically occupy different positions along the business cycle curve. But this go around, COVID caused an unnatural cessation of economic activity. In effect, this reset countries to the cycle’s commencement. The current cycle positioning seems to hinder on 1) the timing of COVID infections and 2) the subsequent timing of reopening.

The four stages of the business cycle are widely recognized with customary traits. Data offers an estimation of where different countries are placed along the curve. China is furthest along the curve. This can be expected since China was the first to experience mass infection spread as well as the first to reopen their economy.

One note of caution, it is tempting to look at this as a horse race to see who wins. However, each country implemented different COVID responses as well as having different economic, demographic and resource dynamics. These will lead to varied cycle durations. For example, during the ’08-’20 U.S. cycle, Europe experienced two cycles, one lasting five years and the other lasting seven years.

¹ https://www.nber.org/cycles.html

CRN-3255246-092420

Recent Comments