Deep Impact! No, I’m not referring to the 1998 Sci-fi movie about a comet striking the Earth. I’m referring to the rate hike shock from the Federal Reserve (Fed). With the latest rate hike this week, the Fed has raised rates 5.0% inside 14 months, the swiftest in modern history. Though not as severe as the Deep Impact Hollywood flick, review of the rate hikes has a lasting impression.

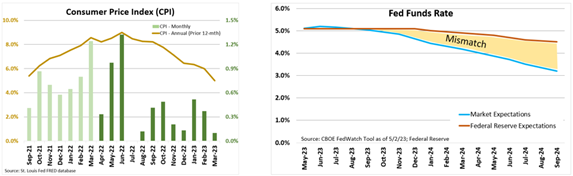

The Fed began its inflation fight in March 2022. Inflation was climbing with little restraint peaking in June 2022. The often-quoted annual inflation, or inflation over the preceding 12 months, overshadows the more apt monthly trend. Review of the monthly numbers demonstrates high inflation months are far behind us. Normalized inflation will be more apparent after the May and June monthly numbers roll off. In fact, annualized inflation since July is… 2.35%! Hard to believe, but it’s true. We’re not calling for 2.35% inflation, just that current trend inflation is lower than many realize.

The Fed has likely struck its last blow. This week was very likely the Fed’s last hike of this cycle. Both Fed comments and market expectations concur, a pause is upon us. Interest rate changes often take 6-12 months to impact the economy, hence a pause now seems appropriate. Afterall, the Fed “broke” something by way of ferreting out some of the lower quality regional banks. At current count, three banks have failed1. Luckily, few banks are as aggressively positioned.

Review of Fed and market rate expectations do raise an eyebrow. The next rate move will likely be down. Higher rates slow an economy while lower rates speed it up. With the Fed induced economic weakness, the Fed will look to reinvigorate the economy once it feels inflation is under control.

Yet, there is a mismatch in the rate reduction timing. The Fed is looking to stand pat for at least the rest of the year, while the market is expecting a rate cut in November2. Both views can’t be correct, so some compromise is likely to happen. To investors, that compromise may be seen as volatility. Given the overall directional agreement, there could be more kiddie-ride volatility as opposed to the rock-em, sock-em action of 2022.

Though the interest rate headwind seems to have resided, risks are present via economic weakness, earnings drought, softening labor markets, and geopolitics. We continue to monitor events as they unfold.

1fdic.gov 2CBOR FedWatch Tool as of 5/2/23 CRN-5669218-050423

Recent Comments