Where are bonds going? That is a question on many minds, professional and amateur alike.

Bond performance for the last couple of years have given bond investors pause. Dramatic interest rate increases resulted in dramatic bond declines. (Bond yields and bond prices are inversely related.) Though there was a rebound in 2023, bonds have been ho-hum so far in 2024 as the Federal Reserve (Fed) lacked conviction for monetary policy guidance. Cash equivalents (CDs, money markets, T-Bills, etc.) offer yields around 5% with effectively low risk to compound the bond exposure decision. What’s it going to take for investors to move back to bonds?

Last week’s Fed meeting just made that decision a little easier. The financial markets applauded Fed Chairman Jerome Powell’s suggestion that rate cuts are on the table if inflation continues towards the Fed’s 2% target. Stock and bond markets rallied on the news and began rate cut posturing.

Cash and cash equivalent yields are highly influenced by the interest rates established by the Fed. So, cash and cash equivalents yields will begin their downward trajectory alongside the Fed’s implementation. At the same time, lower cash yields could entice fixed-income investors to move to higher-yielding bonds, which will also drive up bond prices for appealing total returns.

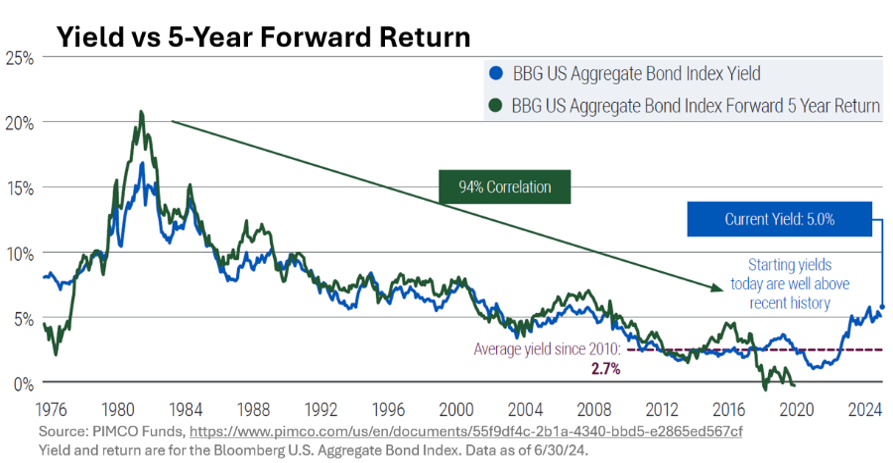

What returns can be expected in the intermediate term? Interestingly, history offers excellent insight. Historical analysis demonstrates a very high correlation between bond yields and returns for the subsequent 5-year period returns. The bond market proxy, the Bloomberg US Aggregate Bond Index, yields about 5%. Hence, investment grade bonds can be expected to approximate an annualized 5% return over the next five years.

With interest rate cuts seemingly on the horizon and cash yields likely to follow suit, bonds are worth a second look. If bond market volatility is still not to your liking, another way to lock in high yields is through longer-term fixed-income vehicles such as longer-dated CDs or Multi-Year Guaranteed Annuities (MYGA), which is the insurance industry’s equivalent to bank CDs. These often come with a lock-up period and/or limited liquidity features.

It’s understandable to shy away from bonds, given the last couple years. A frequent cliché in the investment industry is, “past performance is no guarantee of future returns.” Such compliance edict can’t be truer for bonds than today. The fixed-income market dynamics are being set up for a pivot. We hope you’re enjoying your summer. Believe it or not, Back to School sales are beginning.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation. CRN-6868551-080624

Recent Comments