Who will be the new president? As we come into the election’s home stretch, many are focused on this singular question. We’ve come to find investors often overstate the impact that the federal government has on broad financial markets.

Throughout the year, we’ve tried to objectively point out financial market performance during various government compositions, milestone legislation, and historical events. This is not to say that history repeats itself, but it does paint a very wide backdrop and form reasonable expectations. The main message is that the White House occupant is not as impactful to the financial markets as candidates imply. In fact, monetary policy is likely to have a greater influence on markets in the next few years than any forthcoming legislation or executive action.

US equity returns have historically been strong in presidential election years, averaging 7.5% since 19281. The second-best year for returns typically comes in the last year of the four-year presidential cycle, with most of the returns generated in the year’s second half. But what’s most surprising is that stock volatility is nearly identical during election years and non-election years, going back to 19281.

Markets hate uncertainty, and that tracks with the fact that they perform better in the fourth year of a president’s first term than that of a lame duck president. However, this is an unusual election given Biden’s atypical lame-duck status, so we can potentially rip up that script.

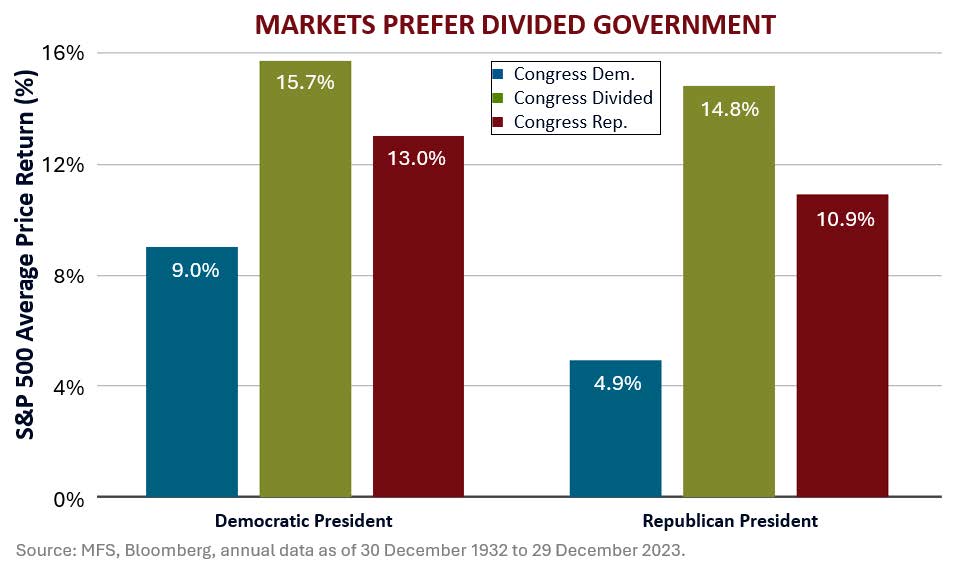

Historical analysis shows that equity markets don’t have a strong preference for which party controls Congress. The reality is that the best performance has been achieved with a divided Congress regardless of who is in the White House. This is because having checks and balances in place between the branches of government helps prevent the passage of overly ambitious policies, which can create uncertainty and volatility in the markets.

While presidential elections matter to the economy and the markets, we believe they matter less than most investors think. Presidents may influence inflation, but they don’t control supply chains, the velocity of money, or base effects. They can propose tax rates, but they can’t anticipate how companies and the public will react to them. And while they may govern during a bull market (and hope to take credit for it), there are many factors that determine the fate of the stock market that are outside of the control of politicians. This election is important, but rigorous fundamental analysis of companies and markets will have more to do with investor outcomes than political analysis. If you care to explore this elections and markets, you may wish to review Invesco’s research. (https://www.invesco.com/us/en/insights/market-performance-2024-presidential-election.html).

Forward looking statements may be subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Diversification may help reduce but cannot eliminate risk of investment losses. Stock market performance is defined by the S&P 500 Index which is a market-capitalization-weighted index of the 500 largest domestic US stocks. An investment cannot be made in an index. Past performance does not guarantee future results.CRN-7216751-102224

Recent Comments