Possible bumpy roads ahead. 2024 concluded with a vibrant Santa Claus rally, pushing elevated stock market valuations into frothy territory. Frothy valuations can signal the market has priced in strong growth expectations. However, when stock valuations reach elevated levels, they can also set the stage for increased market volatility.

Stock valuations are a critical metric in assessing the health and future prospects of financial markets. Elevated, high, or frothy valuations refer to stock prices that are high relative to a company’s earnings, revenues, or other financial indicators making stocks sensitive to unexpected or negative news. This volatility can stem from both internal market dynamics and external economic factors. With current stock valuations at high levels, there is growing concern that the risk of a significant market correction or increased volatility could be on the horizon.

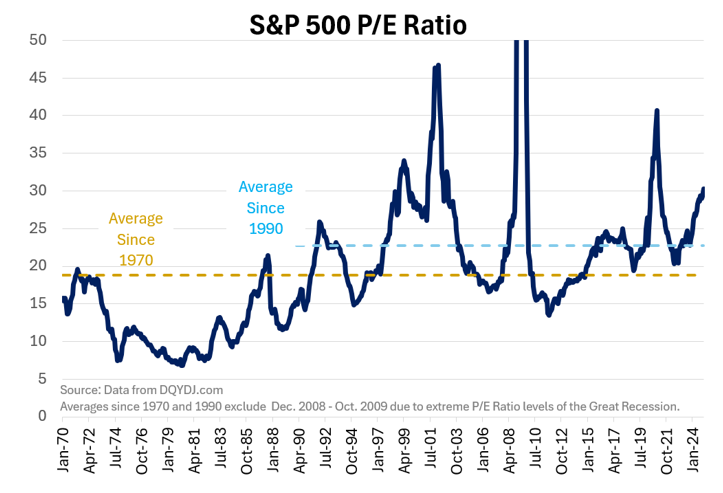

The most common valuation measure is referred to as the Price-to-Earnings ratio or P/E ratio. Current P/E ratio levels and other valuation metrics are high relative to recent past and historical norms. It suggests investors are willing to pay a premium for corporate earnings, anticipating strong earnings growth. However, if that growth does not materialize as expected or if macroeconomic conditions change, it can lead to a stock market correction as investors re-evaluate their expectations.

Higher valuations can be justified in environments with low/falling interest rates, low/falling inflation, or strong earnings growth. All these aspects are present in the current environment. On the flip side, detractors of high valuations are also present, such as consumer fragility, economic timidness, increasing geopolitical risks, and ultimate valuation rotation.

A note of caution: high valuations are not a reason to exit long-term investment objectives. There have been plenty of examples and multi-year periods when stocks have continued their reign with high valuations. There are plenty of “coulda, woulda, shoulda” investors who attempted to time market tops and bottoms. Academic research, as well as real-world experience, has echoed the difficulty of calling tops and bottoms. Mentally preparing for a possible bumpy road ahead has proven to be more fruitful in the long run as it reduces the potential for emotionally driven action.

While high stock valuations can indicate optimism about future growth, they also pose a risk of increased market volatility. If reality fails to meet expectations or if macroeconomic conditions change, investors may face a healthy correction. The combination of inflated price-to-earnings ratios, stubborn inflation concerns, and heightened geopolitical risks sets the stage for potential volatility. As a result, investors should remain vigilant, carefully assess the sustainability of current valuations, and be prepared for possible market fluctuations.

S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market.

CRN-7484472-123024

Recent Comments