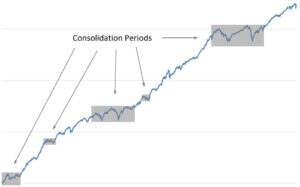

The next market phase has begun. After a sharp upswing, equity markets tend to enter a period of consolidation. Consolidation is a phase when the market is not advancing nor declining but stays within a trading range. Consolidation is considered healthy as markets pause to absorb new information and/or allow fundamentals to catch up to the newly elevated valuations.

Consolidation is a natural aspect of equity investing. It is on display daily. Utilizing past behavior as a guideline, advances are followed by consolidations. The duration of the consolidation varies, as demonstrated by the illustration. Additionally, consolidations regularly include pullbacks.

Over the past couple weeks, volatility has accompanied the market consolidation. This can be expected given the extraordinary circumstances thrust upon investors. Investors are very sensitive to a new information that could point to the future direction of company earnings. This is not isolated to simply economic or market news, but also the direction of domestic and global health developments.

Unfortunately, a second wave of COVID-19 may be developing primarily in the southern portion of the US. At the same time, COVID-19 has been begun to spread into developing nations, notably in Latin American and Southern Asia. The lesser developed health care systems call into question their ability to fight COVID-19 infections. These nations tend to provide raw materials and manufacturing to global business.

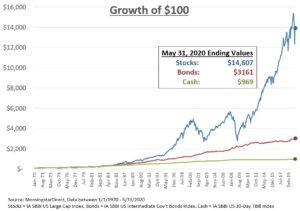

Equity importance as part of a portfolio should not be undermined during consolidation. Not only is consolidation duration unknown, equities undeniably provided strong long-term growth. However, equities also come with short-term volatility, which can be extreme at times.

As we re-enter a very low interest rate environment, investors may ask more of equity investments. Investors will look to equities for growth AND income. This could lead to lower return expectations and higher volatility. As such, a well-diversified portfolio and acceptance of higher volatility will go help investor psyche.

CRN-3141039-062520

Recent Comments