It’s relative! The stock market is an odd animal not easily personified. At times, the market can be a docile church mouse, a yapping chihuahua, or a roaring bear. The market has always been a finicky institution with various theories attempting to justify its progress.

It’s relative! The stock market is an odd animal not easily personified. At times, the market can be a docile church mouse, a yapping chihuahua, or a roaring bear. The market has always been a finicky institution with various theories attempting to justify its progress.

Even to investment professionals, near-term movements can seem counter to reason, oddly inconsistent or even random. But one thing is for sure, near-term stock market returns are relative.

The stock market is often referred to as a forward-looking mechanism. More practically, near-term movements are often the response to what could be coming over the horizon. If the market anticipates improving conditions (not necessarily good or great, just better than current conditions) the stock market can rally, and vice versa.

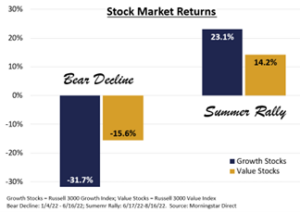

Relativeness can explain two recent periods. The bear decline (1/4/22 – 6/16/22) started with a very good economic environment with deteriorating expectations. Interestingly, a summer rally (6/17/22 – 8/17/22) was sparked from anticipation of improving conditions even with economic data deteriorating.

The performance difference between growth and value stocks was quite striking. Growth stocks fell twice as much as value stocks during the Bear Decline, yet rebounded higher during the Summer Rally. Although rather dramatic over the past eight months, this dichotomy is normal. Growth stocks tend to exhibit a wider range of returns, a.k.a. volatility, than value stocks.

Value companies tend to have more stable business models with more dependable and consistent earnings. Growth stocks often aggressively expand operations accompanied by sloppy allocation of resources which can exaggerate misjudged business risks. Hence, growth stocks tend to have higher highs during goods times and lower lows during bad times.

Think of Proctor and Gamble (PG) as a value stock. PG manufactures daily use cleaning and grooming products, such as shampoo, soap, toothbrushes, and laundry detergent to name a few. These are items used during every economic environment. A growth stock example is Uber Technologies (Uber). Uber is a transportation dispatch company challenging the status quo via supplanting the taxi industry, expanding food delivery, and enabling transportation gig-economy entrepreneurs. However, Uber has not produced an annual profit since 20181. Clearly, PG has a far more dependable and reliable business than Uber.

Near-term market movements are incredibly difficult to time if timing is even possible. However, purposeful portfolio design with growth and value styles can help mitigate the risks of each while earning long-term opportunities.

1Finance.yahoo.com

CRN-4920721-082522

Recent Comments