It’s time for the European Union (EU) to get in the game regarding the vaccine distribution. The EU’s inoculation efforts have been rather dismal at this stage in the game. The U.S. is placing fourth in worldwide inoculation efforts, but the EU isn’t even in the ball game. Although there are many factors at play, the current economic recovery is dependent on returning to normal. Hence, attention towards inoculation is paramount.

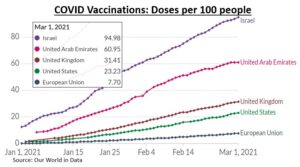

Monitoring COVID inoculations offers insight into the stage of the recovery as well as the economic timing. Small populations and limited geography give Israel and the UAE the upper hand. The UK’s quick vaccine approval and high population concentration pad their numbers. The U.S. comes in fourth, not too bad for the third largest country, geographically and by population. But the EU is in need of a serious boost.

The EU’s sluggish vaccine rollout was a result of a few poorly executed decisions. The first was a new set of restrictions in late 2020 to mitigate a second COVID wave and stifle a third. Secondarily, the EU was slow to approve, accumulate and disseminate vaccines. Even EU officials recognized their ineffectiveness during a February 10th press conference. Lastly and astonishingly, a number of EU countries initially recommended vaccines should not be used for people over 65?!?

The genesis of our global economic trouble starts and ends with COVID. This goes without saying, but it is important to remember that this recession is like no other. Most recessions are a result of reduced material consumption via lower manufacturing, construction or other tangible products. Services tend to revolve around regular and lifestyle needs, i.e. haircuts, banking, healthcare, etc. which experience lower fluctuations.

However, COVID strikes right at the heart of many services, specifically “experience” services. Modern technology has allowed us to order tangible products to our delight but going for a meal and a movie is now verboten. Interestingly, services make up about 77% of the U.S. economy and about 73% of the EU economy. This is why the focus on normalcy is so important. Most countries’ “manufacturing” is expanding. However, manufacturing is only about 15% of the global economy, with industrialized nations below that.

On the flip side, the EU’s sluggishness has also brought desirable stock valuations. EU stock valuations are far below those of the U.S. A tenet of investing is “buy low, sell high.” That is how you grow your assets to achieve your goals and ultimately create income and wealth. Patience is part of investing as well. At the same time, unnecessary obstacles are frustrating. In short, let’s go Europe, you’re holding everyone up.

CRN-3500538-031921

Recent Comments