Ever wonder why an investment’s results are not as expected? How could an investment with favorable historic returns, such heavy promotion and promising outlook not deliver on the forecasts of the best analysts?

Ever wonder why an investment’s results are not as expected? How could an investment with favorable historic returns, such heavy promotion and promising outlook not deliver on the forecasts of the best analysts?

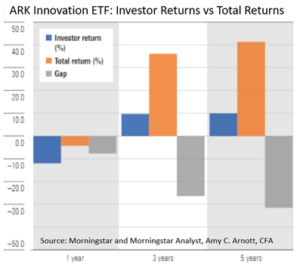

Investor returns can differ from published returns. Seems odd, but it’s true. More or less, the difference comes down to timing. This can be observed via different return calculation methods. (I’ll spare you the technical dissertation.) In short, published returns ignore inflow/outflows, or investor’s dollar commitments.

Let’s look at one recent heavily discussed investment over the past 12-18 months, ARK Innovation ETF (symbol ARKK). This fund invests in cutting edge technology receiving a lot of press. The media picked up on the hot technology trend as well as incredible early returns ushering investor’s attention along with their investment dollars in 2020 and 2021.

Through Tuesday December 14th, the fund was down 24.9% for the year1. With most of the investment dollars coming in late 2020 and through 2021, most investors lost money even through the fund published positive longer returns.

There are many lessons to be learned, especially on the human psychology front. First, chasing trends can be detrimental to your wealth. This is why the financial services industry, requires some form of “past performance is not indicative of future returns” disclosure. This is often ignored or dismissed but is extremely relevant. The second and more elusive psychological trait is overconfidence. Reading or viewing too much from one point of view or interpretation can jaundice one’s mindset delivering undue decision confidence.

Additionally, humans, being herd animals, tend to make decisions that coincides with the group. After all, everyone can’t be wrong… or can they? A cautionary tale of the consensus comes from Astronomer Galileo Galilei. Galileo was jailed from 1633 until his death in 1642 believing the Sun was at the center of the solar system, counter to the prevailing wisdom of the day. Centuries later, he was proven correct.

This is also a cautionary note of the media. The media is not always your friend. The media molds minds without the audience’s knowledge. Being the bullhorn of a great [enter trend here] and citing great recent returns can cause exuberance, divorcing trends from fundamentals with a likely day of reckoning ahead.

With the year coming to an end and holidays upon us, we hope you are enjoying these final days of 2021. 2021 was an interesting year filled with good and bad surprises, but mostly positive. Warmest regards.

1Morningstar Direct

CRN-4016072-122021

Recent Comments