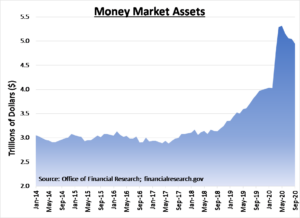

Sitting on the sidelines. That’s what many investors have been doing for months as money market assets exceeded $5 Trillion dollars. In the recent months, money markets have seen a slight shrinkage, yet assets still approximate an astonishing $5 Trillion. The impact and implications can be an important marker.

Money Markets are effectively savings accounts. An asset used to park cash as opposed to investing or purchasing goods and services. The primary benefit is stability. Money market funds maintain a strict $1 per share. Should the price differ from $1, there is a heavy toll to be paid, usually dissolution.

Money market failures are very rare. Since the inception of money markets in the 1970s, only two money markets have “broken the buck” and closed¹. Compare this with bank failures. In any given year, a few bank failures can occur, with 197 bank failures in 2009 and 2010². Due to the need for stability, money markets are very heavily regulated to mitigate failure risk with the most recent regulatory improvement in 2015.

What do money market levels suggest? Since money markets are used to park cash, this suggests either 1) consumers do not want to purchase goods and services, and/or 2) investors would prefer to sit on the sidelines. In either case, near-term uncertainty is the culprit. This explains the jump from $4 Trillion in Feb 2020 to the $5.3 Trillion peak in May 2020. The events during the first half of 2020 are still fresh; COVID outbreak, oil market shock, economic shutdown and extreme market volatility. Near-term uncertainty was on the forefront of everyone’s mind.

Since May, money market assets have slowly whittled down to $5 Trillion from $5.3 Trillion. This is still a considerable sum with plenty of dry power ready to be invested or deployed into the economy. Additionally, recent months have shown individuals are becoming more comfortable and confident about their futures. Clearly, there are signs of uncertainty pressures dissipating. The oil shock has come and gone. COVID vaccines are on the horizon. Market volatility is normalizing. Elections are over. Company earnings exceed expectations. Houses are being purchased. Reduced uncertainty and strengthening economic data will likely result in cash leaving money markets for alternative options. Deployment of cash into the economy will either further economic growth (via the purchase of goods and services) or support higher investable assets prices (via deployment into financial markets).

¹ https://www.investopedia.com/terms/b/breaking-the-buck.asp

² https://www.fdic.gov/bank/historical/bank/

CRN-3336178-111820

Recent Comments