Governmental economic action falls into two categories, monetary policy and fiscal policy. Monetary policy is focused on the money supply, primarily through printing money and controlling interest rates. (Think of a bank that makes loans and sets interest rates on those loans as well as deposits.) Fiscal policy deals with tax and spend policies put forth by congress. (Think of a trade association that collects dues but also offers grants.)

The monetary side has the pedal to the metal. The Federal Reserve has set near-zero interest rates and ensured copious amounts of cash are available. The Federal Reserve is doing what they can to support economic activity, encourage employment and promote business expansion.

Fiscal policy addresses tax and spend policies. Basic Keynesian economic theory (embraced by governments for many decades) is to reduce taxes and increase spending during recessionary or difficult economic times. There are various benefits, but all are centered around getting more money into people’s pockets.

The primary benefit is to offer a financial bridge to help those hit hardest during difficult times. The bridge should help pay mortgages/rent, buy food, pay bills, etc. The absence of a financial bridge could exaggerate an already tenuous situation. For example, mortgage defaults would have the compound effect of homelessness (requiring further governmental outlays such as unemployment benefits and food assistance) and foreclosure (driving down housing prices and thwarting an economic rebound). Since money circulation is economic activity, money in people’s pockets primes the economic pump.

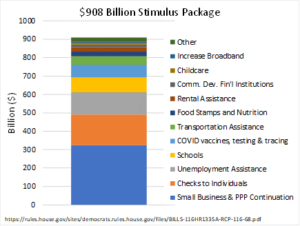

Last week, Congress passed a $908 Billion stimulus package. This is another COVID-era cash infusion directed mostly to low-to-moderate income individuals and small businesses. The stimulus is designed to offer a three-month bridge during the COVID vaccine distribution phase with the hopes that some semblance of normalcy is on the horizon

There are, however, long-term side effects to massive stimuli, as witnessed in 2020. They include potentially higher inflation and interest rates, higher governmental debt service and hinderance addressing future perils. But those are for another day. We first need to get through this extraordinary time period before addressing the historic national debt that our government has accrued over the last few decades. Wishing you a very Happy New Year and returning to a sense of normalcy in 2021.

CRN-3392933-010621

Recent Comments